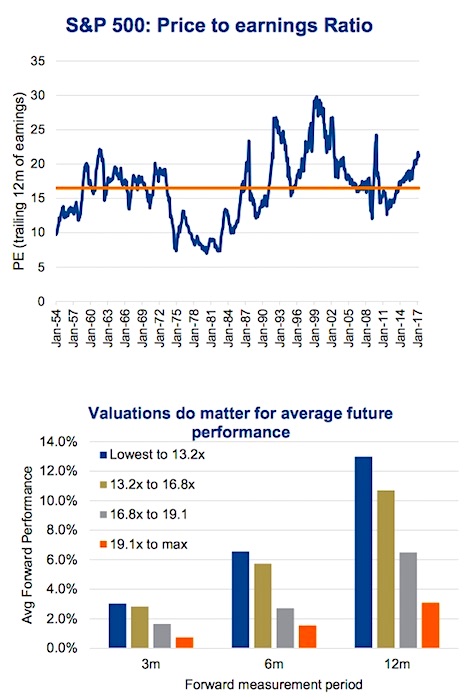

Why Current Stock Market Valuations Are Not A Cause For Alarm (BofA)

Table of Contents

The Impact of Interest Rate Expectations on Stock Market Valuations

Interest rate hikes significantly impact stock market valuations. Higher interest rates increase bond yields, making bonds a more attractive alternative to stocks. This increased attractiveness reduces the relative appeal of stocks, putting downward pressure on their prices. BofA's perspective on future interest rate trajectories is crucial in understanding the impact on valuations.

- Discounted Cash Flow (DCF) and Interest Rates: The DCF model, a common valuation method, discounts future cash flows back to their present value. Higher interest rates increase the discount rate, lowering the present value of future earnings and thus impacting stock valuations.

- BofA's Interest Rate Predictions: BofA's analysts predict [insert BofA's predicted interest rate peak here], followed by [insert BofA's predicted rate cut timeline, if any, here]. These predictions are vital in assessing the long-term impact on market valuations.

- Mitigating Factors: Factors such as strong corporate earnings (discussed below) can mitigate the negative impact of higher interest rates. Furthermore, the market often anticipates future rate cuts, which can lessen the immediate impact on valuations.

Strong Corporate Earnings as a Buffer Against High Valuations

Despite economic headwinds, many companies are demonstrating remarkable resilience and strong corporate earnings. This robust profitability provides a buffer against concerns about high valuations. Are current earnings supporting current valuations? The answer, according to BofA's analysis, is largely yes.

- Sectors with Strong Earnings Growth: [Insert examples of sectors with strong earnings growth, citing data or sources]. These sectors are demonstrating the ability of strong businesses to navigate uncertain economic conditions.

- BofA's Earnings Expectations: BofA's analysis suggests [insert BofA's predictions on earnings for the coming quarters here]. These predictions indicate a continued positive trend in corporate profitability.

- Earnings Per Share (EPS) and Valuations: Earnings per share (EPS) is a key metric for assessing a company's profitability and is directly related to stock valuations. Strong EPS growth helps justify higher valuations.

Inflation's Influence and the Path to Moderation

Inflation plays a complex role in influencing stock market valuations. High inflation typically leads to higher interest rates (as central banks try to curb inflation), impacting valuations as discussed above. Furthermore, high inflation erodes purchasing power and can negatively affect investor sentiment. BofA's view on inflation's trajectory is, therefore, crucial.

- Inflation and Investor Sentiment: High and unpredictable inflation creates uncertainty, leading to decreased investor confidence and potential market volatility.

- BofA's Inflation Predictions: BofA predicts [insert BofA's predictions on the peak of inflation and its subsequent decline here]. These predictions are essential in assessing the long-term implications for market valuations.

- Policy Measures and Inflation: Monetary policy measures undertaken by central banks, such as interest rate adjustments, significantly influence inflation's trajectory. BofA's analysis likely incorporates the potential impact of these policy measures.

Geopolitical Factors and Their Limited Impact on Long-Term Valuations

Geopolitical risks and uncertainties are undeniable. However, BofA's analysis suggests that their impact on fundamental stock market valuations is often limited in the long term. Markets tend to adjust and price in geopolitical risks relatively quickly.

- Specific Geopolitical Events and Market Impact: [Mention specific geopolitical events and their short-term and long-term impact on markets, citing examples and data if available].

- Market Adjustment to Geopolitical Risks: Markets are remarkably adept at factoring in known risks. While short-term volatility may occur, long-term fundamentals often remain largely unaffected by such events.

- Long-Term Investment Strategies: Focusing on a diversified, long-term investment strategy is key to mitigating the impact of short-term geopolitical uncertainty.

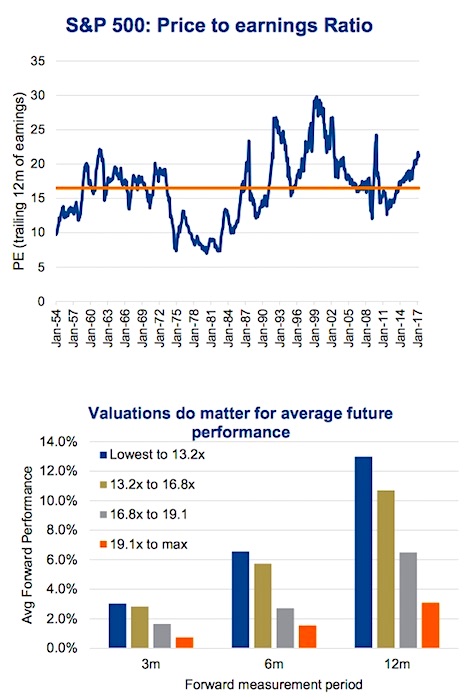

Why You Shouldn't Panic About Current Stock Market Valuations (BofA Perspective)

In summary, while current stock market valuations might seem high at first glance, several key factors—BofA's predictions on interest rate trajectories, robust corporate earnings, the anticipated moderation of inflation, and the often-limited long-term impact of geopolitical risks—suggest they are not necessarily a cause for immediate alarm. Investors should concentrate on long-term strategies, avoiding the pitfalls of reacting to short-term market fluctuations. Remember that market timing is exceptionally difficult, and a balanced approach is essential.

To properly assess your risk tolerance and make informed decisions regarding your investment strategy in light of current stock market valuations, consult with a financial advisor. They can help you develop a portfolio aligned with your financial goals and risk appetite. Don't let short-term anxieties dictate your long-term investment approach to stock market valuations.

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025 -

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 22, 2025

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 22, 2025 -

Stock Market Today Dow Futures Dollar And Trade War Concerns

Apr 22, 2025

Stock Market Today Dow Futures Dollar And Trade War Concerns

Apr 22, 2025 -

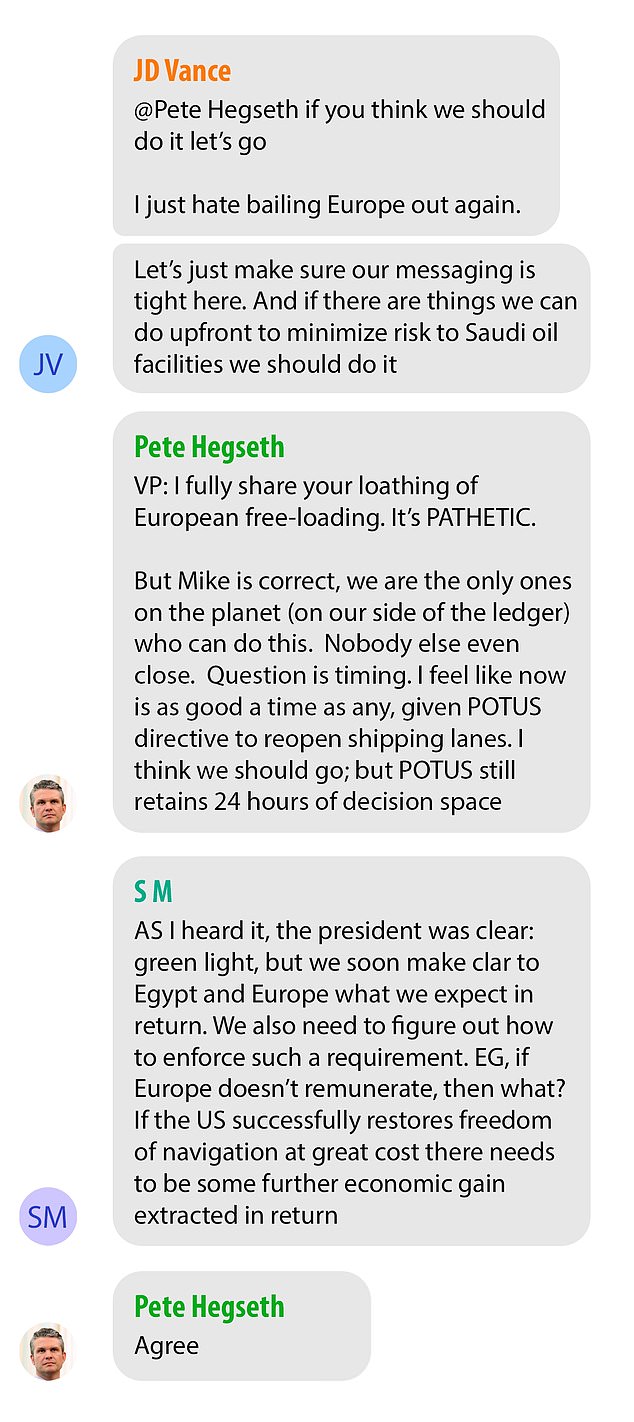

Hegseths Signal Chat Leaked Military Plans With Family

Apr 22, 2025

Hegseths Signal Chat Leaked Military Plans With Family

Apr 22, 2025 -

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025