Stock Market Valuations: BofA's Case For Calm Amidst High Prices

Table of Contents

BofA's Bullish Case Despite High Valuations

BofA's relatively positive outlook, despite high stock market valuations, rests on several key pillars. Their analysts believe that several factors currently support a cautiously optimistic stance. This isn't blind optimism; it's a considered view based on fundamental analysis and economic indicators.

- Strong earnings growth projections: BofA projects continued robust earnings growth for many sectors, suggesting that current valuations may be supported by underlying company performance. This isn't just about the overall market; specific sectors are expected to outperform.

- Favorable interest rate environment: While interest rates are rising, BofA's analysis considers the historical context and anticipates a potentially less aggressive tightening than some fear. Low (or relatively low) interest rates historically correlate with higher stock valuations.

- Positive economic indicators: Positive indicators such as GDP growth and healthy employment numbers paint a picture of continued economic expansion, supporting the case for sustained corporate profits.

- Strong growth potential in specific sectors: BofA has identified specific sectors, such as technology and healthcare, as having particularly strong growth potential, making them attractive even in a high-valuation market.

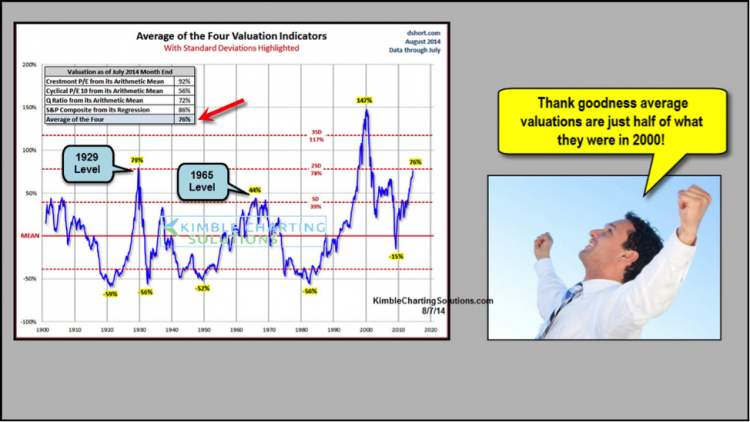

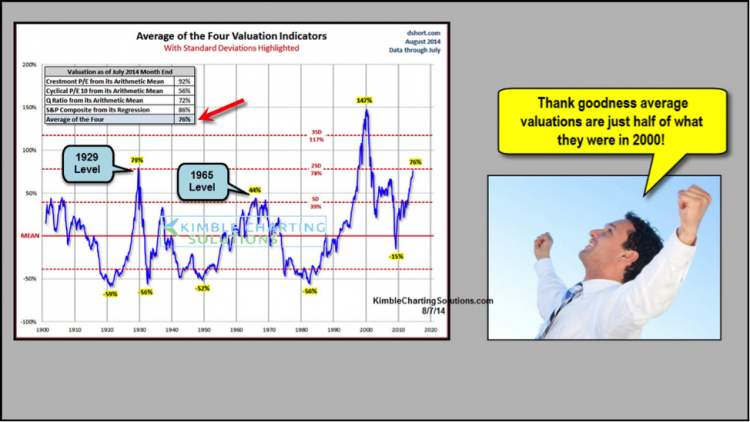

High P/E Ratios: Cause for Concern or Market Inefficiency?

High price-to-earnings (P/E) ratios are a common concern in high-valuation markets. However, BofA's analysis doesn't dismiss these ratios as simply unsustainable.

- Historical context: BofA's analysts compare current P/E ratios to historical averages, acknowledging that they are elevated but arguing that this may be partially justified by several factors.

- Technological advancements and disruptive innovations: The rapid pace of technological advancement and the emergence of disruptive innovations can justify higher valuations for companies poised to benefit from these trends. This suggests that traditional valuation metrics may need to be adjusted.

- Shifts in investor preferences: Changing investor preferences, perhaps driven by factors like low interest rates and the search for yield, can also contribute to higher valuations in certain sectors. These shifts need to be considered when analyzing P/E ratios in isolation.

- Counterarguments to overvaluation fears: BofA argues that the fear of an imminent market crash based solely on high P/E ratios may be overstated. They highlight other metrics and fundamentals that support their bullish case.

BofA's Investment Strategy in a High-Valuation Market

Given the current high stock market valuations, BofA advocates for a strategic approach to investing. Their recommendations don't necessarily call for a complete withdrawal from the market, but rather a more measured and discerning approach.

- Sector-specific investments: BofA suggests focusing investments on specific sectors demonstrating strong growth potential, rather than a broad market approach.

- Diversification strategies: Maintaining a well-diversified portfolio across different asset classes and sectors is crucial to mitigating risk.

- Risk management advice: BofA emphasizes the importance of understanding your own risk tolerance and aligning your investment strategy accordingly. This is a critical consideration in any market but particularly crucial in high-valuation environments.

- Potential hedging strategies: Though not a core recommendation, BofA's analysis acknowledges the potential role of hedging strategies to protect against potential market downturns.

Managing Risk in a High-Valuation Market Environment

Market volatility is inherent, but BofA highlights the need for enhanced risk management in a high-valuation market.

- Potential downside risks: BofA acknowledges potential downside risks, such as rising interest rates, inflation, or geopolitical instability. Understanding these risks is crucial for developing a robust strategy.

- Strategies to mitigate potential losses: Employing strategies such as diversification, stop-loss orders, and potentially hedging can help mitigate potential losses.

- Long-term investment horizons: Maintaining a long-term investment horizon is key to weathering short-term market fluctuations and benefiting from long-term growth potential.

Maintaining Calm Amidst High Stock Market Valuations – A BofA Perspective

BofA's analysis suggests that while high stock market valuations are a valid concern, they are not necessarily a cause for immediate panic. Their cautious optimism is based on strong corporate earnings, a relatively favorable interest rate environment, and positive economic indicators. However, they strongly advocate for a measured approach, emphasizing the importance of understanding your risk tolerance, diversifying your portfolio, and maintaining a long-term perspective.

To navigate the complexities of high stock market valuations successfully, understand your risk tolerance, develop a sound investment strategy, and learn more about BofA's insights on stock market valuations. Don't let fear dictate your decisions; make informed choices based on a thorough understanding of the market and your own financial goals.

Featured Posts

-

Wallace Misses Out On Martinsville Podium Finish

Apr 28, 2025

Wallace Misses Out On Martinsville Podium Finish

Apr 28, 2025 -

New X Financials Debt Sales Impact On Musks Company Strategy

Apr 28, 2025

New X Financials Debt Sales Impact On Musks Company Strategy

Apr 28, 2025 -

Baltimore Orioles Announcers Jinx Snapped 160 Game Hit Streak Over

Apr 28, 2025

Baltimore Orioles Announcers Jinx Snapped 160 Game Hit Streak Over

Apr 28, 2025 -

Nascars Bubba Wallace Inspires Austin Teens Before Cota Race

Apr 28, 2025

Nascars Bubba Wallace Inspires Austin Teens Before Cota Race

Apr 28, 2025 -

Podcast Production Revolutionized Ai And The Poop Podcast Phenomenon

Apr 28, 2025

Podcast Production Revolutionized Ai And The Poop Podcast Phenomenon

Apr 28, 2025