The Role Of Tax Credits In Attracting Film And TV To Minnesota

Table of Contents

The Minnesota Film Tax Credit Program: A Detailed Overview

Minnesota offers a competitive film tax credit program designed to lure productions to the state. This program provides financial incentives to offset production costs, making Minnesota a more attractive filming location compared to states without such programs.

- Percentage of eligible expenses covered: The Minnesota Film Tax Credit offers a 25% credit on qualified production expenses. This means for every dollar spent on qualifying items within the state, producers receive a 25-cent credit against their state tax liability.

- Eligible productions: The credit applies to a wide range of productions, including feature films, television series, commercials, documentaries, and even animation projects that meet specific criteria.

- Requirements for claiming the credit: To qualify, productions must meet certain spending thresholds, demonstrating a significant financial investment in the Minnesota economy. Additionally, a portion of the production must involve in-state hiring, ensuring that Minnesotans benefit directly from the economic activity. Specific details regarding these thresholds and hiring requirements are outlined in the Minnesota Department of Employment and Economic Development (DEED) guidelines.

- Application process: The application process involves submitting a detailed budget and production plan to DEED, which reviews the application to determine eligibility. Once approved, the tax credit is applied after the production is completed and the relevant documentation is submitted.

For more detailed information on application processes and eligibility requirements, visit the official .

Economic Impact of Film Tax Credits on Minnesota

The economic benefits of Minnesota's film tax credit program extend far beyond the immediate production itself. The program acts as a powerful catalyst for growth across various sectors:

- Job creation: Film productions create a significant number of jobs, not only for film crews (directors, cinematographers, editors) but also for support staff (catering, transportation, security) and local businesses that provide services to the production.

- Increased spending by film productions: Productions spend money at local hotels, restaurants, equipment rental companies, and other businesses, injecting much-needed revenue into the local economy. This ripple effect is significant and strengthens the overall financial health of communities where filming takes place.

- Attracting skilled workers: The film tax credit helps attract skilled workers to Minnesota, bolstering the state's film industry workforce and contributing to long-term economic growth. This influx of talent fosters a more robust and competitive film sector within the state.

- Boost to tourism: Filming locations often become popular tourist destinations, bringing in additional revenue through tourism and further promoting Minnesota's diverse landscapes.

[Insert relevant statistics and data here, citing reputable sources like the DEED or economic impact studies].

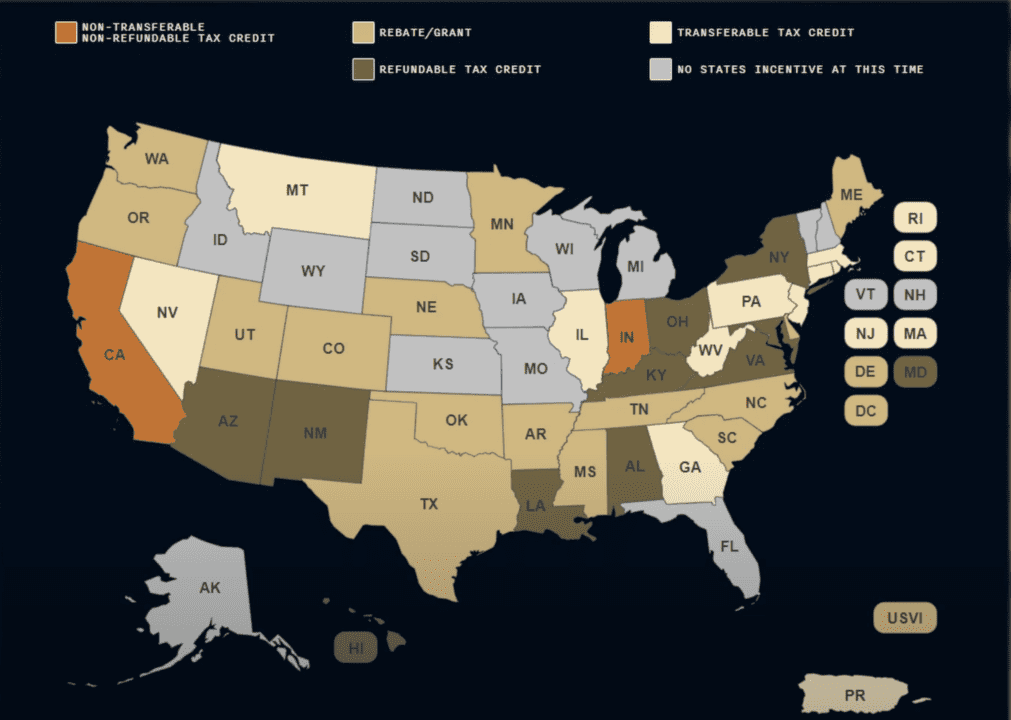

Comparison with Other States' Incentive Programs

Minnesota's film tax credit program is competitive, but it's essential to compare it to other states aggressively pursuing film production.

- Comparison of credit percentages and eligibility criteria: While some states offer higher percentage tax credits, Minnesota's program balances the incentive with eligibility requirements that ensure a tangible return for the state's investment. States like Georgia and California are known for their generous tax credit programs, but they often come with stringent requirements, making Minnesota a more accessible option for some productions.

- Unique aspects of Minnesota's program: Minnesota's program might focus on specific genres or types of productions, offering additional incentives to attract projects that align with the state's economic development goals.

- Overall effectiveness: Analyzing the number of productions attracted, job creation rates, and overall economic impact of the program, compared to others, helps determine its effectiveness. [Insert comparative data in a table or chart here, citing reputable sources].

The Role of Location and Infrastructure in Attracting Productions

Beyond the tax credits, Minnesota's diverse landscapes and developing infrastructure play a significant role in attracting filmmakers:

- Variety of filming locations: From bustling cityscapes to serene lakes and forests, Minnesota offers a variety of stunning locations for productions, offering unique backdrops for diverse storytelling.

- Availability of studio space and production facilities: The growth of studio space and production facilities in the state is essential for attracting larger productions that require substantial infrastructure.

- Relevant infrastructure improvements: Investments in broadband access, transportation networks, and skilled workforce training programs further support the film industry's growth.

The Future of Film Tax Credits and Minnesota's Film Industry

Minnesota's film tax credit program has proven effective in attracting film and television productions, generating significant economic activity, and creating numerous jobs. To maintain its competitiveness, the state should continually evaluate the program’s effectiveness and consider improvements. Potential enhancements could include increasing the credit percentage, expanding eligibility criteria, or focusing on attracting specific high-impact productions.

Explore the benefits of Minnesota's film tax credits and discover how they can help bring your next project to life! Learn more about leveraging Minnesota's film tax credits to boost your production and contribute to the state's thriving film industry.

Featured Posts

-

Us Attorney Generals Warning To Minnesota Compliance With Trumps Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Trumps Transgender Athlete Ban

Apr 29, 2025 -

Anthony Edwards 50 000 Fine For Inappropriate Conduct Towards Fan

Apr 29, 2025

Anthony Edwards 50 000 Fine For Inappropriate Conduct Towards Fan

Apr 29, 2025 -

Anthony Edwards And Ayesha Howard Custody Battle Conclusion

Apr 29, 2025

Anthony Edwards And Ayesha Howard Custody Battle Conclusion

Apr 29, 2025 -

Anthony Edwards Injury Impact On Timberwolves Lakers Game

Apr 29, 2025

Anthony Edwards Injury Impact On Timberwolves Lakers Game

Apr 29, 2025 -

Are Minnesotas Film Tax Credits Competitive Enough

Apr 29, 2025

Are Minnesotas Film Tax Credits Competitive Enough

Apr 29, 2025