Trump's Influence On Bitcoin: Trade And Fed Policies Drive BTC Higher

Table of Contents

Trump's Trade Wars and Bitcoin's Safe Haven Status

Bitcoin, a decentralized digital currency, often acts as a safe haven asset during periods of economic uncertainty. This means investors flock to it when traditional markets appear volatile or risky. Trump's trade policies significantly contributed to such uncertainty.

Increased Volatility in Traditional Markets

Trump's administration implemented numerous tariffs and engaged in several high-profile trade disputes, particularly with China. These actions created considerable volatility in stock markets and other traditional investments.

- Increased market volatility spurred investors to seek alternative assets less correlated with traditional markets.

- Bitcoin's decentralized nature and its lack of correlation with the US dollar and traditional markets made it an attractive option for diversification.

- The trade war with China, for example, led to significant market fluctuations, pushing investors to seek safer alternatives like Bitcoin. The US-China trade tensions peaked in 2018 and 2019, coinciding with periods of increased Bitcoin adoption.

Capital Flight and Bitcoin Investment

As investors sought to hedge against the risks associated with Trump's trade wars, a considerable amount of capital flowed into Bitcoin.

- Data from various cryptocurrency exchanges shows a marked increase in Bitcoin trading volume during periods of heightened trade tensions.

- Analysis of investor behavior during specific trade war escalations reveals a clear pattern of capital flowing from traditional markets into Bitcoin.

- The increased geopolitical risk, largely fueled by Trump's protectionist trade policies, played a significant role in driving Bitcoin prices higher. Uncertainty breeds demand for alternative, decentralized assets like Bitcoin.

The Federal Reserve's Actions Under Trump and their Impact on Bitcoin

The Federal Reserve (Fed) plays a crucial role in setting US monetary policy, influencing the value of the dollar and, consequently, impacting global markets. Trump's presidency saw specific Fed actions that potentially influenced Bitcoin's price.

Quantitative Easing and Inflationary Pressures

The Fed's monetary policies under Trump, including quantitative easing (QE), aimed to stimulate economic growth. However, some economists argued that these policies also contributed to inflationary pressures.

- Inflation erodes the purchasing power of fiat currencies. Bitcoin, with its fixed supply, is often viewed as a hedge against inflation.

- Evidence suggests a correlation between periods of increased money supply (due to QE) and upward movements in Bitcoin's price.

- Several financial experts have noted the potential impact of the Fed's expansionary monetary policy on the cryptocurrency market, suggesting it increased demand for alternative assets like Bitcoin.

Interest Rate Changes and Bitcoin Investment

Changes in interest rates, controlled by the Fed, also influenced investor decisions regarding Bitcoin.

- Low interest rates often encourage investment in riskier assets, including Bitcoin, as the returns from traditional, low-yield investments become less appealing.

- Analysis of Bitcoin price movements shows a tendency for positive correlation with periods of low interest rates implemented by the Federal Reserve.

- The interplay between traditional finance and cryptocurrency investment strategies becomes evident here: As opportunities in traditional markets diminish, investors may shift their focus to potentially higher-yielding assets such as Bitcoin.

The Narrative of "Trump and Bitcoin": Media Influence and Public Perception

The media played a significant role in shaping the narrative surrounding Trump's policies and Bitcoin's price.

The Role of Social Media

Social media amplified the connection between Trump's actions and Bitcoin's price movements.

- Numerous media outlets published articles connecting Trump's trade policies and the Fed's decisions to the rise of Bitcoin.

- Social media platforms became echo chambers for various opinions and speculations, often exaggerating the relationship between Trump's policies and Bitcoin's price.

- Misinformation and speculation, often spread through social media, significantly impacted Bitcoin's market volatility during this period.

Public Sentiment and Investment Decisions

Public perception of Trump's policies directly influenced investment decisions in Bitcoin.

- Surveys and polls conducted during this period indicated a rise in public interest in Bitcoin, often linked to uncertainty about traditional markets.

- Correlation analysis shows that positive media coverage often preceded or accompanied rises in Bitcoin's price, whereas negative sentiment had the opposite effect.

- Trust and confidence, or lack thereof, in established financial systems during the Trump era played a significant role in shaping investment behavior in the cryptocurrency market.

Conclusion

In summary, Trump's economic policies, encompassing trade wars and Federal Reserve actions, inadvertently fostered a climate of uncertainty that significantly boosted Bitcoin's appeal as a safe haven asset and a hedge against inflation. The way the media portrayed this relationship further influenced public perception and investment decisions. Understanding Trump's influence on Bitcoin is crucial for navigating the complex world of cryptocurrency. Continue your exploration of the relationship between political and economic events and the cryptocurrency market by researching further into the impact of current global economic instability and emerging regulatory frameworks. Learn more about the intricate factors influencing Bitcoin's price and how to effectively manage your investments in this volatile yet potentially rewarding market. Further research into Trump's influence on Bitcoin will provide deeper insights into this fascinating interplay.

Featured Posts

-

Liams Unpredictable Actions And Bridgets Shocking Find The Bold And The Beautiful April 16 Recap

Apr 24, 2025

Liams Unpredictable Actions And Bridgets Shocking Find The Bold And The Beautiful April 16 Recap

Apr 24, 2025 -

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025 -

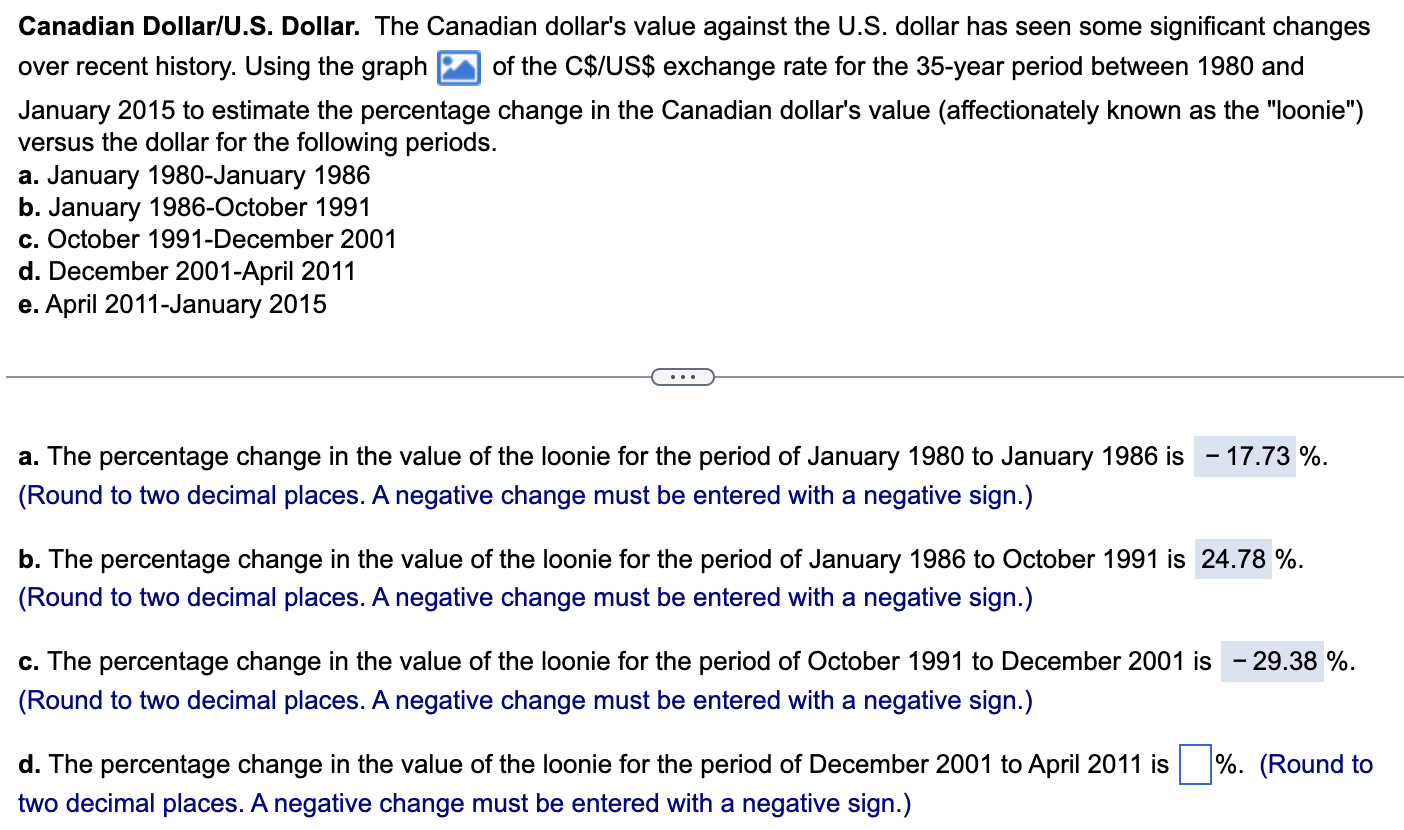

Analyzing The Canadian Dollars Strength Against The Usd And Weakness Elsewhere

Apr 24, 2025

Analyzing The Canadian Dollars Strength Against The Usd And Weakness Elsewhere

Apr 24, 2025 -

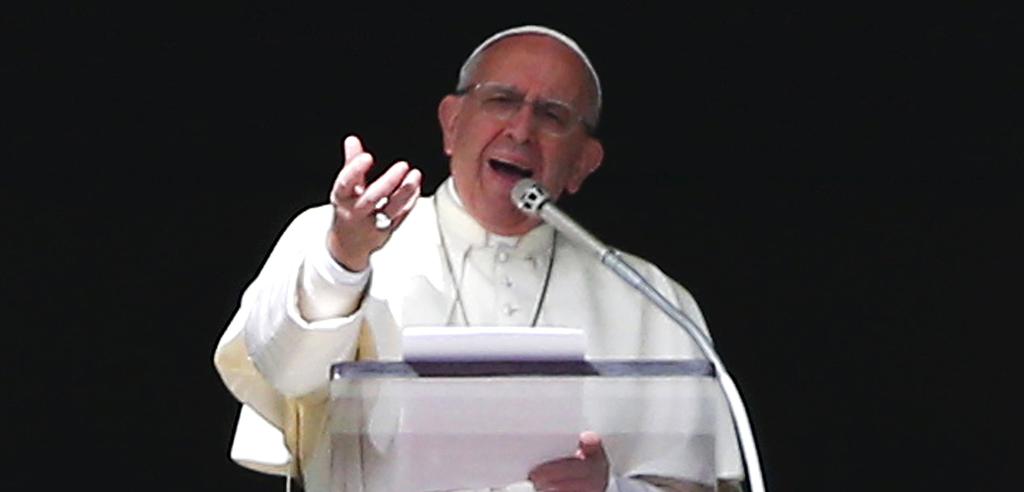

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025 -

Bold And The Beautiful April 23rd Spoilers Finns Commitment To Liam

Apr 24, 2025

Bold And The Beautiful April 23rd Spoilers Finns Commitment To Liam

Apr 24, 2025