Trump's Scathing Criticism Of Jerome Powell: Demand For Removal

Table of Contents

Reasons Behind Trump's Criticism of Jerome Powell

Trump's animosity towards Powell stemmed from several key factors, primarily revolving around interest rate hikes and Powell's perceived lack of loyalty.

Interest Rate Hikes and Economic Slowdown

Trump consistently believed that Powell's interest rate increases were intentionally designed to undermine his presidency and hinder his reelection chances. He viewed these hikes as a deliberate attempt to stifle economic growth and negatively impact his administration's economic achievements.

- December 2018: The Fed raised interest rates for the fourth time in 2018, bringing the federal funds rate to a target range of 2.25% to 2.5%. Trump publicly criticized this move, arguing it was too aggressive.

- March 2019: Another rate hike followed, further fueling Trump's discontent. He frequently lamented the impact on the stock market and business investment.

- July 2019: Despite slowing economic growth, Trump expressed his frustration with the Fed's continued tightening of monetary policy.

These rate hikes coincided with a slowdown in GDP growth and a period of increased market volatility. While the Fed's actions were ostensibly aimed at combating inflation and ensuring long-term economic stability, Trump interpreted them as a direct attack on his political agenda. His frequent public pronouncements, including tweets and press conferences, amplified this narrative. For instance, he repeatedly referred to Powell's policy as "crazy" and "ridiculous." This period saw GDP growth decelerating from a robust 4.2% in Q2 2018 to a much lower 2.1% by Q2 2019, further fueling Trump's narrative of sabotage.

Powell's Independence and Perceived Lack of Loyalty

Beyond economic policy, Trump's frustration stemmed from the Federal Reserve's inherent independence from direct political influence. He expected unwavering support from Powell, viewing the Fed's actions as a betrayal of his administration's economic policies. Trump's public statements frequently questioned Powell's competence and loyalty, directly challenging the established norms of central bank autonomy.

- Trump's repeated assertions that Powell should prioritize short-term economic growth over long-term stability challenged the established role of the Federal Reserve.

- The constitutional structure of the Fed, designed to insulate it from political pressure, was repeatedly undermined by Trump's actions and statements.

- The importance of an independent central bank in maintaining economic stability and credibility was consistently disregarded in Trump's pronouncements.

The Impact of Political Pressure on the Federal Reserve

The open criticism and attempted influence by the President represent a significant threat to the Federal Reserve's credibility and its ability to make unbiased decisions based solely on economic data. This political pressure has far-reaching consequences:

- Erosion of Trust: Political interference can undermine public trust in the Fed's independence and its ability to manage the economy effectively.

- Market Instability: Uncertainty surrounding the Fed's independence can lead to increased market volatility and reduced investor confidence.

- International Implications: Such actions can also negatively impact the global perception of the US financial system's stability. Similar instances of political pressure on central banks in other countries have often resulted in negative economic consequences.

The Demand for Powell's Removal and its Consequences

Trump's repeated calls for Powell's dismissal were a stark demonstration of his dissatisfaction.

Trump's Calls for Powell's Dismissal

Trump openly and frequently voiced his desire to remove Powell, using various platforms to express his discontent.

- Numerous tweets and public statements directly criticized Powell’s leadership and called for his replacement.

- Interviews and press conferences further amplified his calls for Powell's dismissal. However, the legal and practical challenges associated with removing a Federal Reserve Chairman made this a difficult task. The Chairman serves a 14-year term, making dismissal extremely difficult and legally complex.

The Impact on Financial Markets

Trump's criticism and calls for Powell's removal had a demonstrable impact on financial markets.

- Market volatility increased significantly during periods of heightened political pressure on the Fed. This uncertainty fueled speculation and investment decisions.

- Investor confidence fluctuated, directly reflecting the ongoing tension between the President and the Federal Reserve Chairman. Charts illustrating market movements during this period would clearly show a correlation between Trump's pronouncements and market fluctuations.

Long-Term Implications for the Federal Reserve's Autonomy

Trump's actions have raised serious concerns about the long-term implications for the Federal Reserve's independence and effectiveness.

- Future presidents might feel emboldened to exert similar pressure on the central bank, eroding its autonomy further.

- This potential for political interference could hinder the Fed's ability to manage the economy effectively in the future, compromising its credibility and long-term stability.

Conclusion: Understanding Trump's Scathing Criticism of Jerome Powell

Trump's intense criticism of Jerome Powell stemmed from disagreements over interest rate policies and a fundamental clash over the independence of the Federal Reserve. His repeated calls for Powell's removal represented a direct challenge to the established norms of central bank autonomy. The potential long-term consequences of politicizing the Federal Reserve are significant, potentially undermining its ability to manage the US economy effectively. Maintaining the Fed's independence is paramount to the health of the US economy. We urge readers to conduct further research into "Trump's scathing criticism of Jerome Powell" and the broader implications of political interference in monetary policy. Further reading on the Federal Reserve's independence and the role of central banks in economic management is highly recommended.

Featured Posts

-

Reds End Goalless Run In Defeat Against Brewers

Apr 23, 2025

Reds End Goalless Run In Defeat Against Brewers

Apr 23, 2025 -

Keider Monteros Struggles As Tigers Lose Series Finale To Brewers

Apr 23, 2025

Keider Monteros Struggles As Tigers Lose Series Finale To Brewers

Apr 23, 2025 -

Aaron Judges Three Homers Highlight Yankees Record Setting Game

Apr 23, 2025

Aaron Judges Three Homers Highlight Yankees Record Setting Game

Apr 23, 2025 -

April Dominance Cy Young Winners Strikeouts Even With A 9 Run Lead

Apr 23, 2025

April Dominance Cy Young Winners Strikeouts Even With A 9 Run Lead

Apr 23, 2025 -

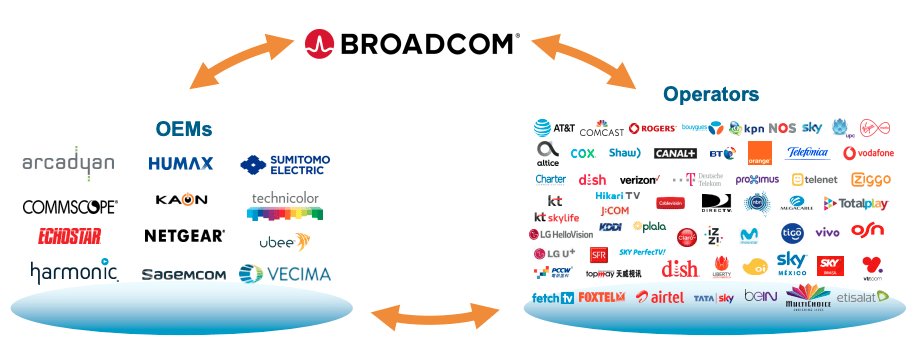

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increases

Apr 23, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increases

Apr 23, 2025