U.S. Dollar's First 100 Days Under Scrutiny: A Comparison To The Nixon Era

Table of Contents

The Nixon Shock of 1971: A Historical Precedent

The Nixon shock, a series of economic measures announced in August 1971, dramatically altered the global monetary landscape. Facing persistent balance of payments deficits and rising inflation, President Nixon made the controversial decision to close the gold window, effectively ending the Bretton Woods system where the U.S. dollar was pegged to gold. This action, coupled with a 10% devaluation of the dollar against other major currencies, sent shockwaves through the global economy.

The consequences were far-reaching:

- Closing of the gold window: This severed the direct link between the U.S. dollar and gold, shifting the world towards a fiat currency system.

- Devaluation of the dollar: This made U.S. exports more competitive but also fueled inflation globally.

- Impact on international trade: The devaluation initially benefited the U.S. but also triggered retaliatory measures and trade disputes.

- Inflationary pressures: The shock contributed to a period of significant inflation, impacting economies worldwide.

- Shift to a fiat currency system: This fundamental change in the global monetary system had lasting repercussions, shaping the international financial architecture we see today.

The political climate leading up to the shock was characterized by growing economic anxieties, social unrest, and a sense of crisis. The Vietnam War and escalating domestic spending contributed significantly to the U.S.'s economic woes.

The Current State of the U.S. Dollar: Key Indicators

The U.S. dollar today faces a different but equally complex set of challenges. High inflation, driven by factors like supply chain disruptions and increased energy prices, is a major concern. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have created uncertainty in the financial markets. The substantial U.S. national debt also contributes to concerns about the dollar's long-term stability. Furthermore, the ongoing war in Ukraine, rising global tensions, and persistent trade imbalances are adding to the pressure.

Key indicators reflecting the current state of the U.S. dollar include:

- Current inflation rate and its impact: Persistently high inflation erodes purchasing power and weakens the dollar's value relative to other currencies.

- Federal Reserve policy and interest rate changes: Aggressive interest rate hikes aim to cool the economy but can also trigger a recession or negatively impact financial markets.

- U.S. national debt and its influence: A large national debt can create uncertainty about the U.S.'s ability to repay its obligations, potentially weakening the dollar.

- Global economic uncertainty and its effects: Global economic slowdowns, recessions, and political instability contribute to dollar volatility.

- Geopolitical risks impacting the dollar: Geopolitical events, such as wars and trade disputes, can significantly impact investor confidence and the dollar's value.

A Comparative Analysis: Similarities and Differences

Comparing the economic climate of 1971 to the present reveals both striking similarities and crucial differences. Both eras witnessed significant inflationary pressures and concerns about the stability of the U.S. dollar. In both instances, policy responses aimed at addressing economic imbalances triggered ripple effects across the global economy. However, the global economic landscape differs significantly. The current globalized financial system is far more interconnected and complex than that of the early 1970s.

- Comparison of inflation rates: While both periods experienced inflation, the causes and global ramifications differed.

- Comparison of policy responses: The Federal Reserve's response today is markedly different from the Nixon administration's actions.

- Comparison of global market reactions: Today’s interconnected markets react far more swiftly and intensely to economic news.

- Differences in the global financial system: The current financial system is far more integrated and susceptible to global shocks.

- Technological differences affecting markets: Today's high-frequency trading and instant global information flows amplify market volatility.

The Role of Geopolitical Factors

Geopolitical factors played a crucial role in both the Nixon era and the present. The Vietnam War significantly contributed to the U.S.'s economic woes in 1971, adding to inflationary pressures and balance of payments deficits. Similarly, today's geopolitical instability, including the war in Ukraine and escalating tensions between major world powers, contributes to uncertainty in financial markets and impacts the dollar's value.

- Specific geopolitical events impacting both eras: Comparing the specific impacts of these events on currency markets provides valuable insights.

- Impact on currency markets: Geopolitical instability often leads to increased volatility in currency exchange rates.

- Impact on investor confidence: Uncertainty stemming from geopolitical events erodes investor confidence, affecting capital flows and impacting the dollar.

Conclusion: The Future of the U.S. Dollar – Lessons from the Past

The comparison between the Nixon era and the current situation reveals that while the specific circumstances differ, the fundamental challenges facing the U.S. dollar share common threads: inflationary pressures, policy responses with unintended consequences, and the crucial role of geopolitical events. Understanding the historical context of the U.S. dollar's fluctuations is critical for navigating the present and predicting future trends. The future trajectory of the U.S. dollar will likely depend on the effectiveness of economic policy responses, the resolution of geopolitical tensions, and the overall health of the global economy.

To stay informed about the U.S. dollar's performance and its impact on the global economy, regularly check reliable financial news sources and analyze expert opinions on the U.S. dollar outlook. Understanding the historical context of the U.S. dollar's fluctuations—including events like the Nixon shock—is essential for informed decision-making in today's volatile financial landscape. Stay informed about the U.S. dollar forecast and prepare for potential future scenarios.

Featured Posts

-

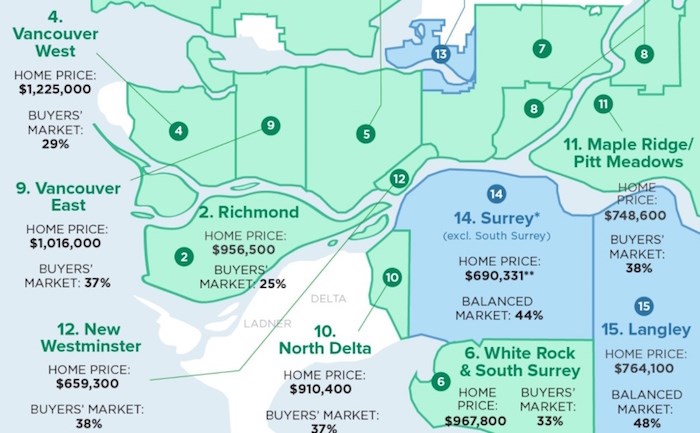

Metro Vancouver Housing Market Slower Rent Growth Persistent Cost Increases

Apr 28, 2025

Metro Vancouver Housing Market Slower Rent Growth Persistent Cost Increases

Apr 28, 2025 -

70 Off Hudsons Bay Liquidation Sale Now On At Remaining Locations

Apr 28, 2025

70 Off Hudsons Bay Liquidation Sale Now On At Remaining Locations

Apr 28, 2025 -

Red Sox Vs Blue Jays Lineups Walker Buehlers Start And Outfielders Return

Apr 28, 2025

Red Sox Vs Blue Jays Lineups Walker Buehlers Start And Outfielders Return

Apr 28, 2025 -

Monstrous Beauty A Feminist Reimagining Of Chinoiserie At The Met

Apr 28, 2025

Monstrous Beauty A Feminist Reimagining Of Chinoiserie At The Met

Apr 28, 2025 -

Mets Finalize Starting Rotation The Last Two Spots Filled

Apr 28, 2025

Mets Finalize Starting Rotation The Last Two Spots Filled

Apr 28, 2025