Understanding High Stock Market Valuations: A BofA Investor Guide

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors can lead to elevated stock market valuations. Understanding these drivers is the first step in formulating a sound investment strategy.

Low Interest Rates

Low interest rates are a significant catalyst for high stock market valuations. This is because:

- Lower Discount Rates: Low borrowing costs reduce the discount rate used in valuation models (like the discounted cash flow model). This leads to higher present values of future earnings, making stocks appear more attractive.

- Increased Corporate Borrowing: Companies can borrow money cheaply, leading to increased share buybacks (reducing the number of shares outstanding and thus increasing earnings per share) and expansion, both of which can boost stock prices.

- Search for Yield: With low returns on bonds and other fixed-income investments, investors seek higher returns elsewhere, driving capital into the equity markets, increasing demand and pushing prices higher. This increases the market valuation of stocks.

Strong Corporate Earnings Growth

Sustained growth in corporate profits fuels investor confidence and significantly increases the demand for stocks. Several factors can contribute to this:

- Technological Advancements: Innovation and technological advancements drive productivity and efficiency, leading to substantial earnings growth for many companies.

- Economic Growth: Strong economic growth usually translates to higher corporate earnings as businesses experience increased sales and demand.

- Improved Profitability: Efficient management, cost-cutting measures, and improved operational efficiency all contribute to higher profitability and thus higher stock valuations.

Increased Investor Sentiment and Speculation

Positive investor sentiment, often fueled by factors such as technological breakthroughs or government stimulus packages, can drive stock prices beyond what fundamental analysis alone would suggest.

- Fear of Missing Out (FOMO): The fear of missing out on potential gains can lead to speculative buying, further inflating valuations and creating a self-fulfilling prophecy. This is a key driver of high market valuations.

- Media Influence: News and media coverage can significantly impact investor sentiment, creating market momentum that might not be entirely justified by underlying fundamentals.

- Retail Investor Participation: Increased participation from retail investors, often through online trading platforms, can heighten market volatility and amplify the impact of sentiment-driven price swings.

Quantitative Easing (QE) and Monetary Policy

Central bank monetary policies, such as quantitative easing (QE), can inject significant liquidity into the market, impacting asset prices, including stock market valuation.

- Increased Money Supply: QE increases the money supply, potentially leading to inflation and higher asset prices. This increased liquidity can find its way into the stock market, increasing demand.

- Lower Borrowing Costs: Lower interest rates, a common outcome of QE, make borrowing cheaper, encouraging both businesses and consumers to invest, further boosting demand and market valuation.

- Economic Impact Debate: The long-term impact of QE on asset valuations is complex and continues to be debated among economists.

Implications of High Stock Market Valuations for Investors

High stock market valuations present both opportunities and significant challenges for investors.

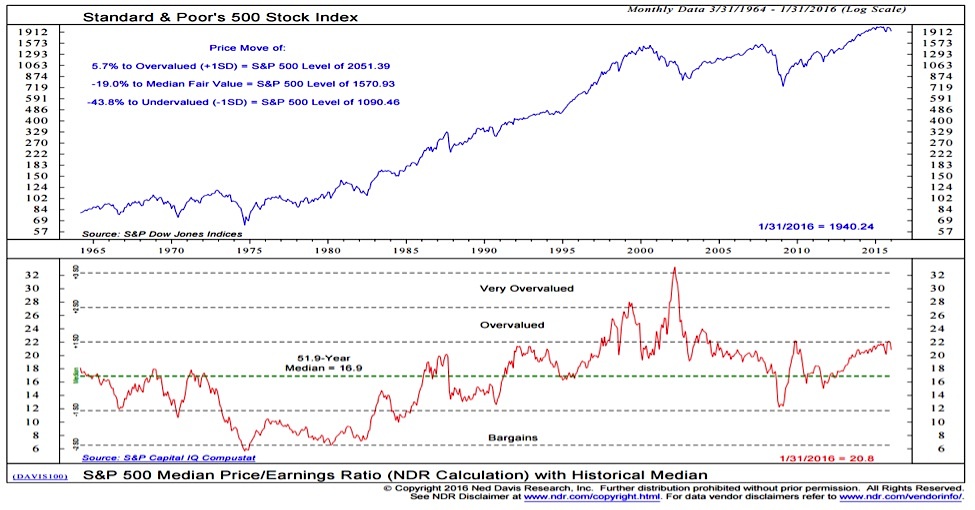

Increased Risk of Corrections and Market Volatility

High valuations often precede market corrections or even crashes, as prices become unsustainable relative to underlying fundamentals.

- Vulnerability to Negative News: High valuations leave less room for error, making stocks more susceptible to negative news and economic shocks, leading to sharp price declines.

- Market Volatility: High valuations often correlate with increased market volatility, meaning significant price swings in short periods.

- Preparation for Downturns: Investors should be prepared for potential market downturns and have a well-defined risk management strategy in place.

Lower Expected Future Returns

Stocks purchased at high valuations generally offer lower expected future returns compared to those bought at lower valuations.

- Reduced Capital Appreciation: The potential for significant capital appreciation is naturally reduced when buying at high valuations.

- Longer Holding Periods: Investors may need to hold stocks for a longer period to achieve their desired returns, requiring patience and a long-term investment horizon.

- Alternative Investment Strategies: Investors may need to consider alternative investment strategies to achieve their financial goals.

Challenges in Identifying Undervalued Opportunities

High valuations make it more difficult to identify undervalued stocks, requiring a more rigorous and discerning approach.

- Thorough Fundamental Analysis: Thorough fundamental analysis and valuation techniques are crucial to identify companies trading below their intrinsic value.

- Sustainable Growth: Focus on companies with strong fundamentals, sustainable competitive advantages, and long-term growth prospects.

- Diversification: Diversification across different sectors and asset classes is essential to reduce risk and improve overall portfolio performance.

Strategies for Managing Your Portfolio During High Valuations

Several strategies can help investors navigate the challenges presented by high stock market valuations.

Diversification

Diversifying your investment portfolio across different asset classes (bonds, real estate, commodities, etc.) is crucial to mitigate the risk associated with high stock market valuations.

- Reduce Sector Concentration: Reduce exposure to sectors that are perceived as overvalued.

- Alternative Investments: Explore alternative investments with low correlation to the stock market.

- Risk Tolerance: Allocate assets based on your risk tolerance and long-term investment goals.

Value Investing

Focus on identifying undervalued companies with strong fundamentals and a margin of safety.

- Fundamental Analysis: Conduct thorough fundamental analysis, focusing on factors like earnings, cash flow, and balance sheet strength.

- Intrinsic Value: Look for companies trading below their estimated intrinsic value.

- Long-Term Perspective: Value investing requires patience and a long-term investment horizon.

Defensive Investing

Adopt a more cautious approach, focusing on companies with stable earnings and lower volatility.

- Dividend-Paying Stocks: Prioritize dividend-paying stocks to generate income during periods of market uncertainty.

- Strong Balance Sheets: Focus on companies with strong balance sheets and lower debt levels.

- Reduce Equity Exposure: Consider reducing your overall equity exposure to mitigate potential losses.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions and protecting your portfolio. While periods of high valuations offer the potential for growth, they also increase the risk of market corrections and lower expected returns. By carefully considering the factors contributing to high valuations and employing strategies such as diversification, value investing, and defensive investing, you can better navigate this challenging environment. Remember to consult with a financial advisor before making any major investment decisions. Continue learning about managing your investments during periods of high stock market valuations for long-term success. Don't hesitate to seek further guidance on navigating high stock market valuations.

Featured Posts

-

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 24, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 24, 2025 -

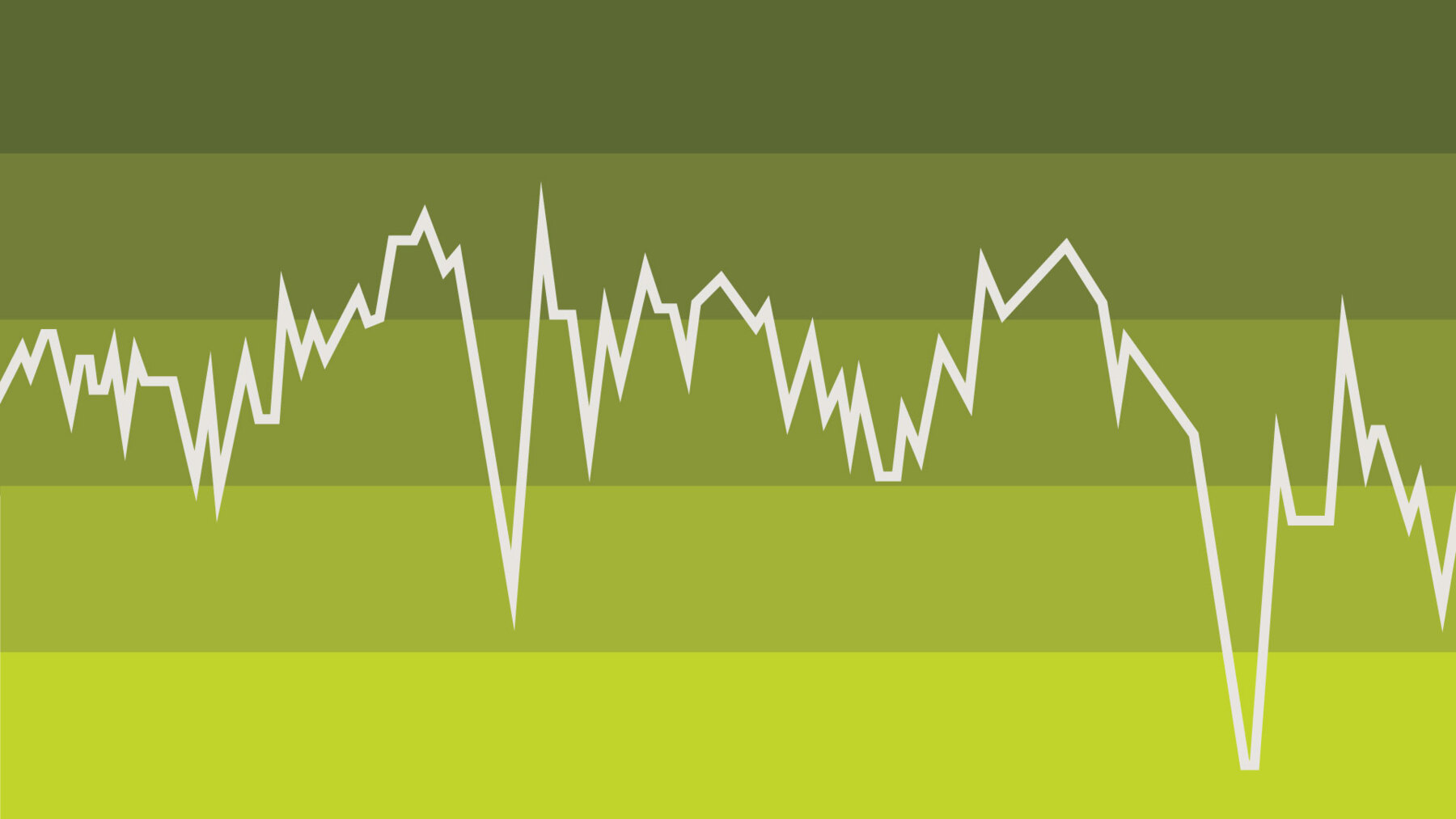

Trumps Immigration Policies A Wave Of Legal Opposition

Apr 24, 2025

Trumps Immigration Policies A Wave Of Legal Opposition

Apr 24, 2025 -

John Travoltas Family Home Addressing The Recent Photo Controversy

Apr 24, 2025

John Travoltas Family Home Addressing The Recent Photo Controversy

Apr 24, 2025 -

The Business Of Deportation How One Startup Airline Is Making It Work

Apr 24, 2025

The Business Of Deportation How One Startup Airline Is Making It Work

Apr 24, 2025 -

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 24, 2025

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 24, 2025