Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Arguments Against Immediate Market Correction Based on Valuation

BofA's analysis challenges the knee-jerk reaction to high valuations. Their perspective emphasizes the need for a more nuanced understanding of market dynamics.

The Importance of Contextualizing Valuation Metrics

Price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and other valuation metrics are frequently cited as indicators of market overvaluation. However, BofA argues these are not standalone indicators. Their effectiveness depends heavily on the broader economic context.

- Low interest rates can justify higher P/E ratios. When borrowing costs are low, companies can invest more aggressively, leading to higher earnings and justifying higher valuations. This is because the discount rate used to calculate present value of future earnings is lower.

- Strong earnings growth can offset seemingly high valuations. If a company's earnings are growing rapidly, a high P/E ratio might simply reflect future growth potential rather than overvaluation. This is often seen in fast-growing technology companies.

- Comparison to historical valuations in similar economic climates is crucial. Simply comparing current valuations to historical averages without considering the prevailing economic environment can be misleading. BofA emphasizes the importance of contextual analysis.

The Role of Corporate Earnings Growth in Justifying High Valuations

BofA's analysis highlights projected corporate earnings growth as a key factor supporting current valuations. Their research suggests that robust earnings growth can significantly mitigate concerns about overvaluation.

- Data points supporting strong projected earnings for specific sectors. BofA often points to strong projected earnings in sectors like technology, healthcare, and consumer staples, driven by factors such as innovation and increasing consumer demand.

- Examples of companies exceeding expectations and driving valuation increases. Specific examples of companies that have significantly exceeded earnings expectations, thereby justifying their high valuations, are frequently cited in BofA reports.

- Discussion of the sustainability of these earnings growth projections. BofA's analysis carefully considers the sustainability of these earnings projections, acknowledging potential risks and providing a balanced view.

Addressing the "Overvalued" Narrative

The common narrative linking high valuations to inevitable market crashes is challenged by BofA. They provide counterarguments supported by data and historical precedent.

- Historical examples of high valuations not leading to immediate market corrections. BofA points to historical instances where high valuations persisted for extended periods without resulting in significant market crashes.

- Mention specific BofA reports or analyses supporting this viewpoint. Their research reports and market commentaries often contain specific data and analysis to support their claims.

- Emphasis on the importance of a long-term investment horizon. BofA consistently stresses the importance of taking a long-term view rather than reacting to short-term market fluctuations.

Factors Supporting BofA's Optimistic Outlook

Beyond addressing valuation concerns directly, BofA highlights several positive economic and technological factors supporting their optimistic outlook.

Positive Economic Indicators

BofA points to several positive economic indicators that strengthen their case against an immediate market correction.

- Specific economic data points cited by BofA. This includes data on employment rates, consumer spending, and other key economic indicators.

- Analysis of the strength and sustainability of these indicators. BofA's analysts carefully analyze the strength and sustainability of these trends, acknowledging potential downside risks.

- How these indicators influence investor confidence and market valuations. Positive economic data generally boosts investor confidence, which can support higher valuations.

Technological Advancements and Innovation

Technological advancements are a major driver of long-term growth, potentially justifying current high valuations.

- Examples of sectors benefitting from technological innovation. BofA highlights sectors such as technology, healthcare, and renewable energy as prime examples.

- Discussion of the potential for future technological breakthroughs and their impact on valuations. The potential for future innovations and disruptive technologies is considered a key factor supporting long-term growth.

- Long-term growth projections supported by these advancements. BofA's projections often incorporate the impact of these technological advancements on long-term economic growth.

Strategies for Navigating High Valuations

Even with a positive outlook, BofA emphasizes the importance of strategic investing in the face of high valuations.

Diversification

Diversification across asset classes is crucial for mitigating risk.

- Examples of diverse investment strategies. This includes a mix of stocks, bonds, real estate, and other asset classes.

- The role of diversification in mitigating risk associated with high valuations. Diversification helps to reduce the overall impact of any single investment performing poorly.

Long-Term Investment Perspective

Maintaining a long-term investment horizon is key to weathering short-term market volatility.

- Data supporting the outperformance of long-term investors. Historical data demonstrates the superior returns achieved by investors with a long-term focus.

- Advice for avoiding emotional decision-making based on short-term market volatility. BofA encourages investors to avoid impulsive decisions driven by fear or greed.

Conclusion

BofA's analysis suggests that while high stock market valuations are a valid concern, they are not necessarily a harbinger of an imminent crash. By considering contextual factors such as interest rates, earnings growth, and economic indicators, investors can adopt a more nuanced perspective. Focusing on diversification and maintaining a long-term investment horizon remains crucial. Don't let fear of high stock market valuations paralyze you. Utilize BofA's insights to develop a robust and informed investment strategy. Learn more about managing your portfolio in the face of high valuations and discover how to make informed investment decisions.

Featured Posts

-

Trump Denies Plans To Fire Fed Chair Powell A Stable Economy

Apr 24, 2025

Trump Denies Plans To Fire Fed Chair Powell A Stable Economy

Apr 24, 2025 -

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Storylines

Apr 24, 2025

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Storylines

Apr 24, 2025 -

Btc Price Increase A Look At The Role Of Trumps Policies And Fed Decisions

Apr 24, 2025

Btc Price Increase A Look At The Role Of Trumps Policies And Fed Decisions

Apr 24, 2025 -

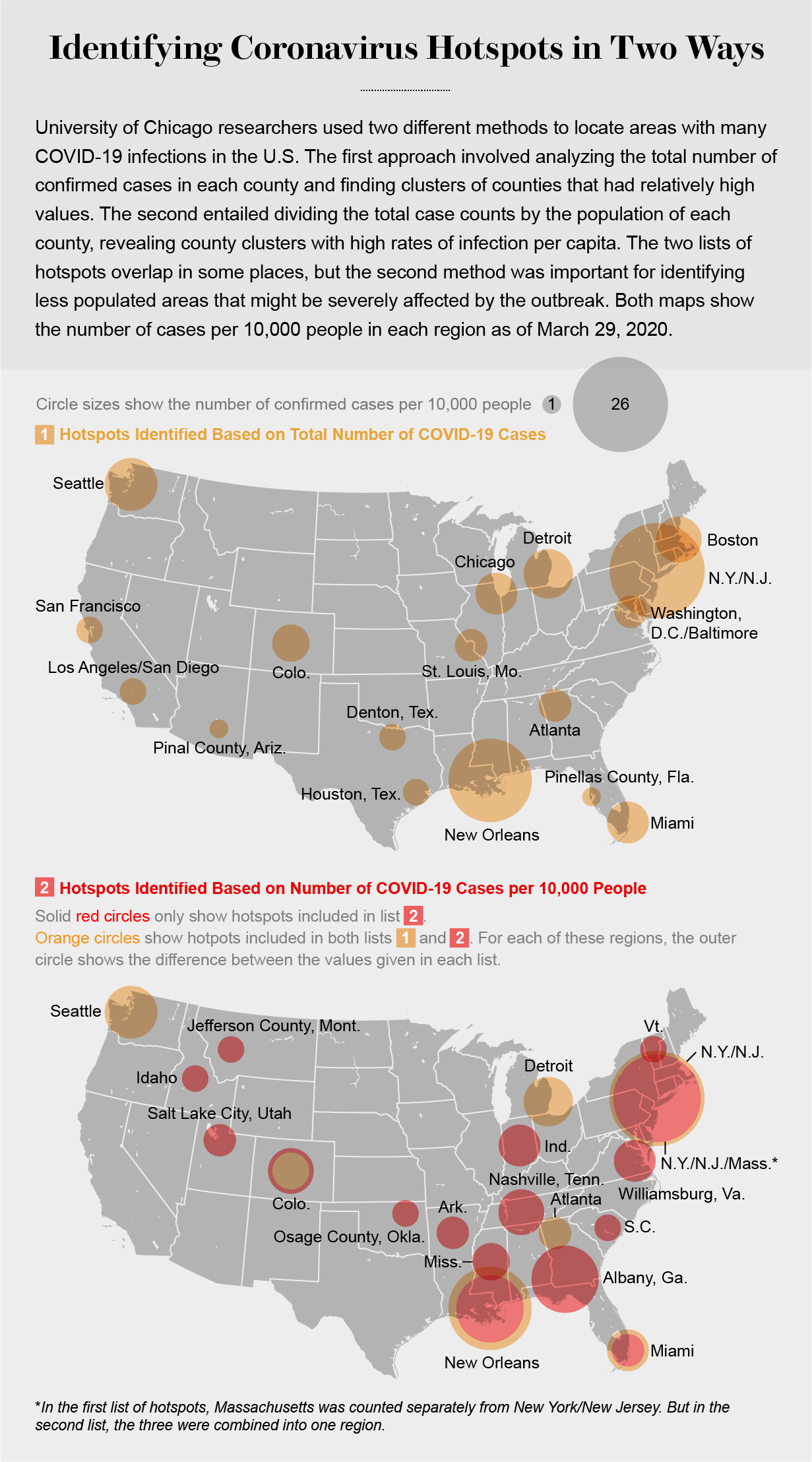

Mapping The Rise Of New Business Hot Spots Across The Nation

Apr 24, 2025

Mapping The Rise Of New Business Hot Spots Across The Nation

Apr 24, 2025 -

Tarantinov Prezir Film S Travoltom Koji Je Odbio Pogledati

Apr 24, 2025

Tarantinov Prezir Film S Travoltom Koji Je Odbio Pogledati

Apr 24, 2025