BTC Price Increase: A Look At The Role Of Trump's Policies And Fed Decisions

Table of Contents

Trump's Economic Policies and their Impact on BTC

Trump's presidency was marked by significant economic policy shifts that arguably influenced the BTC price increase. These policies created both opportunities and uncertainties within the financial landscape, indirectly impacting Bitcoin's appeal.

Deregulation and Increased Uncertainty

Trump's deregulation policies, aimed at loosening financial regulations, inadvertently created uncertainty in traditional markets. This uncertainty potentially pushed some investors towards alternative assets like Bitcoin, seeking a hedge against risk and potential market volatility.

- Reduced regulatory oversight of financial institutions: Less stringent regulations might have increased the perceived risk in traditional investments, making Bitcoin's decentralized nature more appealing.

- Increased trade tensions and geopolitical instability: Trump's trade policies and foreign relations created an environment of uncertainty, prompting investors to seek havens for their assets. Bitcoin, often perceived as a decentralized and less susceptible to geopolitical risks, benefited.

- Uncertainty fueled investor search for safe haven assets, including BTC: The uncertainty surrounding traditional markets drove a flight to safety, with some investors viewing Bitcoin as a potential store of value, contributing to a BTC price increase.

Fiscal Stimulus and Inflationary Pressures

Trump's fiscal stimulus packages, while designed to boost the US economy, also contributed to inflationary pressures. This inflationary environment increased the attractiveness of Bitcoin, often seen as a hedge against inflation.

- Tax cuts leading to increased government spending: The increased money supply fueled inflationary concerns.

- Potential for devaluation of the US dollar: Inflationary pressures raised concerns about the devaluation of the US dollar, leading some investors to seek alternative assets like Bitcoin.

- Increased demand for inflation-resistant assets like BTC: Bitcoin's limited supply and decentralized nature made it an attractive alternative to traditional assets during inflationary periods, contributing to a BTC price increase.

The Federal Reserve's Role in BTC Price Fluctuations

The Federal Reserve's monetary policy decisions, particularly in response to inflationary pressures inherited and exacerbated from the Trump era, significantly impacted the broader financial markets and, consequently, the Bitcoin price.

Interest Rate Hikes and Quantitative Tightening

The Federal Reserve's efforts to combat inflation through interest rate hikes and quantitative tightening significantly impacted investor behavior and capital flows. These policies indirectly affected BTC prices.

- Higher interest rates make holding non-yielding assets like BTC less attractive: Higher interest rates on traditional investments reduced the relative attractiveness of Bitcoin, which doesn't offer interest payments.

- Reduced liquidity in traditional markets might push investors toward alternative assets: The tightening monetary policy might have reduced liquidity in traditional markets, making Bitcoin a more liquid alternative.

- Impact of quantitative tightening on market volatility and BTC price: The Fed's actions increased market volatility, which impacted Bitcoin prices, sometimes positively and sometimes negatively, depending on investor sentiment.

The Impact of Monetary Policy on Investor Behavior

Changes in monetary policy significantly influence investor risk appetite and asset allocation. This, in turn, has a noticeable impact on the demand for and price of Bitcoin.

- Shift in investor sentiment towards riskier assets during periods of low interest rates: Low interest rates encourage risk-taking, potentially boosting demand for Bitcoin.

- Increased risk aversion during periods of tightening monetary policy: Conversely, tightening monetary policy increases risk aversion, potentially reducing demand for Bitcoin.

- The role of market speculation and investor confidence: Investor sentiment and speculation play a massive role in Bitcoin price fluctuations, often amplified by changes in monetary policy.

Correlation or Causation? Analyzing the Relationship between Macroeconomic Factors and BTC Price Increase

While Trump's policies and the Fed's responses played a role, it's crucial to avoid oversimplifying the relationship between these macroeconomic factors and the BTC price increase. The increase was likely a complex interplay of various influences.

- Examining statistical correlations between macroeconomic indicators and BTC price movements: Statistical analysis can help determine the strength of the relationship between macroeconomic factors and Bitcoin's price.

- Considering other potential drivers of BTC price increase, such as technological innovation: Advancements in blockchain technology and increased adoption of cryptocurrencies also contributed to Bitcoin's price appreciation.

- Analyzing the impact of media coverage and investor sentiment: Media narratives and investor sentiment can significantly influence Bitcoin prices, independent of macroeconomic factors.

Conclusion

The recent BTC price increase is a multifaceted phenomenon influenced by a complex web of factors. While Trump's economic policies and subsequent Federal Reserve decisions undoubtedly played a significant role, it's crucial to acknowledge the interplay of other variables, such as technological advancements and investor sentiment. Understanding this complex relationship between macroeconomic trends and cryptocurrency markets is essential for informed decision-making. Further research into the long-term impact of these policies on the BTC price increase is warranted. Continuously monitor news and analysis related to BTC price increase and related keywords like "Bitcoin price prediction," "Bitcoin market analysis," and "cryptocurrency investment" to make informed investment decisions. Stay informed to navigate the future BTC price increase trends effectively.

Featured Posts

-

Reduced Consumer Spending A Challenge For Credit Card Companies

Apr 24, 2025

Reduced Consumer Spending A Challenge For Credit Card Companies

Apr 24, 2025 -

Understanding The Crucial Role Of Middle Managers In Modern Organizations

Apr 24, 2025

Understanding The Crucial Role Of Middle Managers In Modern Organizations

Apr 24, 2025 -

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 24, 2025

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 24, 2025 -

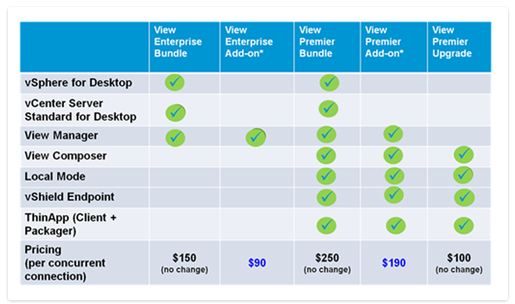

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

Apr 24, 2025

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

Apr 24, 2025 -

Chainalysis Acquisition Of Alterya Expanding Ai Capabilities In Blockchain

Apr 24, 2025

Chainalysis Acquisition Of Alterya Expanding Ai Capabilities In Blockchain

Apr 24, 2025