Understanding The Current GPU Price Volatility

Table of Contents

The Impact of Cryptocurrency Mining on GPU Prices

The relationship between cryptocurrency mining and GPU prices is undeniable. Cryptocurrencies like Bitcoin and Ethereum rely on complex computational processes to verify transactions and add new blocks to the blockchain. GPUs, with their parallel processing capabilities, are exceptionally efficient at these calculations, making them highly sought-after by cryptocurrency miners.

This heightened demand from miners often far outstrips the supply of available GPUs, creating artificial scarcity and driving up prices.

- Increased demand from miners outstrips supply: Miners often purchase GPUs in bulk, leaving less available for consumers.

- Miners often purchase GPUs in bulk, further reducing availability for consumers: This bulk purchasing power exacerbates existing shortages.

- The impact of specific cryptocurrencies (e.g., Ethereum) on GPU market fluctuations: The rise and fall of specific cryptocurrencies directly impacts GPU demand. Ethereum's shift away from GPU mining to a proof-of-stake model, for example, significantly reduced demand.

Conversely, cryptocurrency market crashes can lead to a sudden drop in GPU prices as miners sell off their hardware. This volatility makes the GPU market unpredictable for both buyers and sellers.

Global Chip Shortages and Supply Chain Disruptions

The ongoing global semiconductor chip shortage significantly impacts GPU production and availability. This shortage stems from a confluence of factors, including logistical issues, factory closures, and transportation bottlenecks.

- The role of geopolitical instability and trade wars: Geopolitical tensions and trade restrictions disrupt supply chains and hinder the production of essential components.

- Increased demand across multiple industries (automobiles, electronics) competing for limited chip supplies: The surge in demand across multiple sectors further exacerbates the existing shortage.

- Manufacturing challenges and capacity limitations: Production facilities struggle to meet the heightened demand, leading to further delays and limited supply.

These shortages have long-term implications for GPU availability and pricing, creating a situation where even high-end GPUs remain difficult to find at their MSRP.

The Role of Scalpers and Resellers in GPU Price Inflation

Scalpers and resellers significantly contribute to GPU price inflation by purchasing large quantities of GPUs at retail prices and reselling them at vastly inflated prices on online marketplaces and auction sites.

- The impact of bots and automated purchasing on availability: Automated purchasing systems allow scalpers to acquire large quantities of GPUs quickly, further reducing consumer access.

- The ethical considerations of scalping and its effects on consumers: Scalping exploits the high demand and limited supply, unfairly impacting consumers who are forced to pay exorbitant prices.

- Strategies to avoid purchasing from scalpers: Be wary of significantly inflated prices, do thorough research, and look for reputable retailers.

Combating scalping requires a multifaceted approach, including measures to limit bulk purchases and stronger enforcement against price gouging.

Predicting Future GPU Price Trends: Analyzing Market Indicators

Predicting future GPU price trends involves analyzing several key factors. Historical data reveals patterns, but market conditions are complex and often unpredictable.

- The impact of new GPU releases on the market: The launch of new GPU models can temporarily impact prices, either increasing or decreasing depending on demand and availability.

- The influence of technological advancements and innovations: Breakthroughs in GPU technology can affect price points, while demand for specific features will also influence costs.

- Economic factors influencing consumer spending on electronics: Economic downturns can dampen consumer spending, potentially leading to lower GPU prices.

While precise predictions are challenging, understanding these factors enables a better grasp of potential price fluctuations. We can expect continued volatility in the short term, influenced by the ongoing chip shortage and fluctuating cryptocurrency markets.

Conclusion: Understanding and Navigating GPU Price Volatility

GPU price volatility is a result of several interconnected factors: cryptocurrency mining’s fluctuating demand, persistent global chip shortages, the actions of scalpers and resellers, and the unpredictable nature of technological advancements and economic conditions. Understanding these forces is crucial for making informed purchasing decisions. By staying informed about market trends, technological innovations, and economic indicators, you can become a more astute consumer and navigate the complexities of the GPU market effectively. Stay tuned for updates and further analysis on this dynamic landscape.

Featured Posts

-

Yankees Aaron Judge Matches Babe Ruths Legendary Record

Apr 28, 2025

Yankees Aaron Judge Matches Babe Ruths Legendary Record

Apr 28, 2025 -

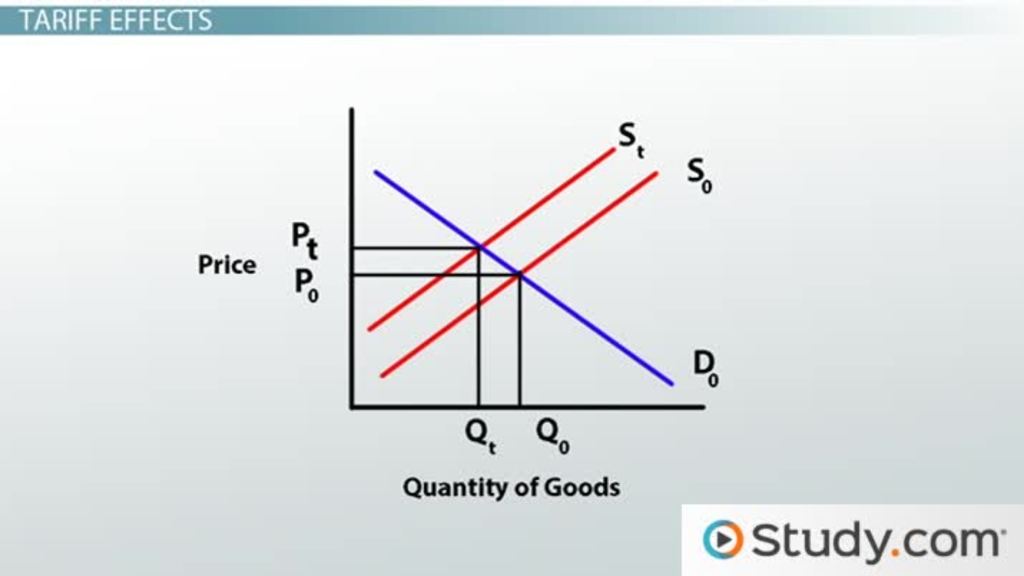

Us China Trade Partial Tariff Relief For American Goods

Apr 28, 2025

Us China Trade Partial Tariff Relief For American Goods

Apr 28, 2025 -

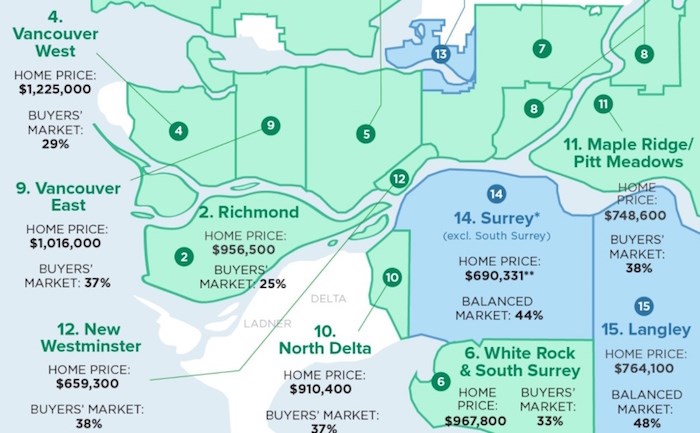

Metro Vancouver Housing Market Slower Rent Growth Persistent Cost Increases

Apr 28, 2025

Metro Vancouver Housing Market Slower Rent Growth Persistent Cost Increases

Apr 28, 2025 -

Ftc Launches Probe Into Open Ai A Deep Dive Into The Investigation

Apr 28, 2025

Ftc Launches Probe Into Open Ai A Deep Dive Into The Investigation

Apr 28, 2025 -

Updated Mets Rotation Who Has The Edge

Apr 28, 2025

Updated Mets Rotation Who Has The Edge

Apr 28, 2025