US-China Trade Tensions: Impact On Dow Futures And The Stock Market Today

Table of Contents

The Current State of US-China Trade Relations: A Complex Landscape

The relationship between the US and China has been defined by periods of cooperation and intense competition, most notably in the realm of trade. A history of trade imbalances, accusations of intellectual property theft, and differing technological ambitions has fueled escalating tensions.

- Key Historical Events: The imposition of tariffs on billions of dollars worth of goods, beginning in 2018, marked a significant escalation of the trade war. Subsequent negotiations yielded some agreements, but underlying tensions remain.

- Current Trade Policies and Tariffs: While some tariffs have been reduced or removed, significant tariffs remain in place on various goods, impacting both US and Chinese industries. These tariffs directly influence production costs, pricing, and overall economic activity.

- Ongoing Negotiations and Potential Outcomes: The current state of negotiations is dynamic, with potential for further escalation or de-escalation depending on political and economic factors. Uncertainty surrounding future trade policies contributes significantly to market volatility.

- Relevant Keywords: trade tariffs, trade war, bilateral trade, trade negotiations, economic sanctions.

Direct Impact on Dow Futures: Immediate Market Reactions

Escalating trade tensions directly impact Dow futures contracts, often acting as a leading indicator of broader market sentiment. Negative news related to US-China trade, such as the announcement of new tariffs or the breakdown of negotiations, typically leads to:

- Immediate Price Fluctuations: Dow futures prices often decline sharply in response to negative trade news, reflecting investor concerns about potential economic slowdown. This is due to the perceived negative impact on corporate earnings and economic growth.

- Mechanisms of Impact: The impact is transmitted through several channels, including investor sentiment, reduced consumer and business confidence, and concerns about global supply chain disruptions. This uncertainty leads to increased market volatility.

- Historical Examples: Previous instances of increased trade war rhetoric have demonstrably caused sharp declines in Dow futures, offering historical context for understanding current market reactions.

- Short-Term vs. Long-Term Effects: The immediate impact on Dow futures is usually more pronounced in the short term. However, prolonged trade tensions can lead to more significant long-term consequences, affecting economic growth and corporate profitability.

- Keywords: Dow futures, futures contracts, market volatility, price fluctuations, short selling, hedging strategies.

Broader Stock Market Impacts: Ripple Effects Across Sectors

The consequences of US-China trade tensions extend far beyond Dow futures, affecting various economic sectors:

- Technology Sector: The tech sector, heavily reliant on global supply chains and intellectual property rights, is particularly vulnerable to trade disputes.

- Manufacturing: US and Chinese manufacturers are directly impacted by tariffs, affecting production costs and competitiveness.

- Agriculture: Agricultural exports from both countries have been significantly affected by retaliatory tariffs, leading to price fluctuations and market instability.

- Investor Sentiment: Negative trade news significantly impacts investor sentiment, leading to decreased investment and increased stock market volatility.

- Supply Chain Disruptions: Trade disputes disrupt global supply chains, impacting production schedules and potentially causing shortages.

- Keywords: stock market volatility, investor sentiment, supply chain disruption, economic uncertainty, sector performance, global trade.

Analyzing the Relationship: Correlation between Trade Tensions and Stock Market Performance

While a direct causal relationship isn't always straightforward, statistical analysis can reveal correlations between trade tensions and stock market performance:

- Correlation Analysis: Studies using econometric models can identify correlations between specific trade policy measures (tariffs, sanctions) and changes in the Dow Jones Industrial Average and other market indices.

- Economic Indicators: Monitoring economic indicators like consumer confidence, manufacturing PMI, and GDP growth can provide insights into the overall economic impact of trade disputes and their effect on the stock market.

- Predictive Modeling: Quantitative analysts use various models to predict potential market reactions to upcoming trade news or policy changes. This helps assess market risk.

- Keywords: correlation analysis, economic indicators, market prediction, quantitative analysis, risk assessment.

Investor Strategies in Times of Trade Uncertainty

Navigating the uncertainty caused by US-China trade tensions requires a proactive approach to investment management:

- Diversification: Diversifying your investment portfolio across different asset classes and geographies reduces your exposure to the specific risks associated with US-China trade disputes.

- Hedging Strategies: Using hedging techniques, such as options or futures contracts, can mitigate potential losses during periods of increased market volatility.

- Monitoring Key Indicators: Stay informed about developments in US-China trade relations by following news and analysis from reliable sources. Monitor key economic indicators to assess the overall economic impact of trade disputes.

- Seeking Professional Advice: Consulting with a financial advisor can provide personalized guidance tailored to your investment goals and risk tolerance.

- Keywords: investment strategies, risk management, portfolio diversification, hedging, asset allocation, investment advice.

Conclusion: Understanding the US-China Trade Landscape and Protecting Your Investments

The impact of US-China trade tensions on Dow futures and the broader stock market is significant and complex. Understanding the dynamics between trade policy and market performance is vital for making informed investment decisions. Fluctuations in Dow futures often serve as an early warning system for broader market reactions. By actively monitoring trade developments, employing diversification strategies, and potentially using hedging techniques, investors can better navigate this challenging landscape. Stay ahead of the curve by regularly monitoring US-China trade relations and their impact on Dow futures and the broader stock market. Develop informed investment strategies to navigate this complex landscape effectively.

Featured Posts

-

The Ahmed Hassanein Story Will He Become Egypts First Nfl Draft Pick

Apr 26, 2025

The Ahmed Hassanein Story Will He Become Egypts First Nfl Draft Pick

Apr 26, 2025 -

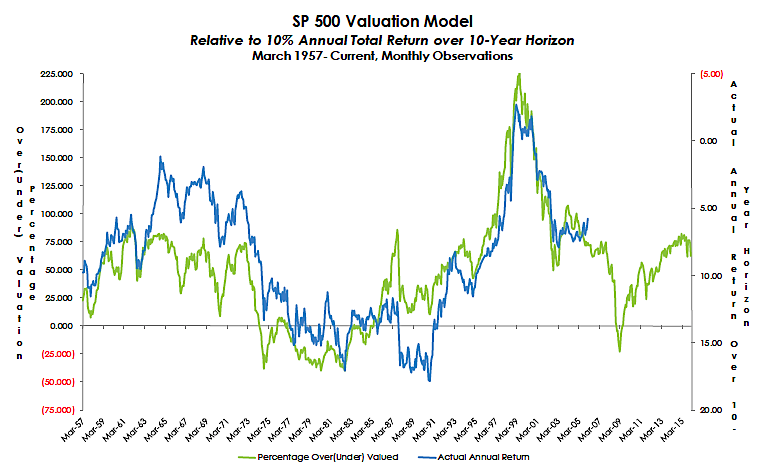

Why Stretched Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 26, 2025

Why Stretched Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 26, 2025 -

Exclusive Pentagon Chaos Shakes Pete Hegseth Polygraph Threats Leaks And Infighting

Apr 26, 2025

Exclusive Pentagon Chaos Shakes Pete Hegseth Polygraph Threats Leaks And Infighting

Apr 26, 2025 -

Chinas Auto Industry Disruptor Or Mainstream Player

Apr 26, 2025

Chinas Auto Industry Disruptor Or Mainstream Player

Apr 26, 2025 -

Chinese Cars Quality Affordability And Global Impact

Apr 26, 2025

Chinese Cars Quality Affordability And Global Impact

Apr 26, 2025