US Market Slump: Emerging Markets Post Positive Returns

Table of Contents

Reasons for the US Market Slump

Several factors have contributed to the recent downturn in the US market.

High Inflation and Interest Rate Hikes

The Federal Reserve's aggressive interest rate hikes to combat high inflation have significantly impacted US equities and bond markets.

- Increased borrowing costs: Higher interest rates make it more expensive for businesses to borrow money, hindering investment and expansion.

- Reduced consumer spending: Rising interest rates increase borrowing costs for consumers, leading to decreased spending and potentially slowing economic growth.

- Impact on corporate profitability: Higher interest rates can squeeze corporate profits, leading to lower valuations and impacting stock prices. This is particularly relevant to businesses with high debt levels. Understanding this interest rate impact is crucial for navigating the US market downturn and potentially seeking inflation hedges.

Geopolitical Uncertainty

Global events have added to the US market volatility. The war in Ukraine, for instance, has created significant geopolitical risk.

- Supply chain disruptions: The conflict has disrupted global supply chains, leading to shortages and increased prices for various goods.

- Energy price volatility: The war has exacerbated existing energy price volatility, impacting inflation and overall economic stability.

- Investor risk aversion: Geopolitical uncertainty often leads to increased investor risk aversion, causing capital flight from riskier assets, including US equities. Investors are increasingly considering how to mitigate global market volatility and adjust their investment strategy accordingly.

Tech Sector Correction

The technology sector has experienced a significant correction, impacting the broader US market.

- Overvaluation concerns: Many tech stocks were significantly overvalued before the correction, leading to a sharp decline in their prices.

- Decreased investor confidence: Concerns about the tech sector's growth prospects have decreased investor confidence, contributing to the overall market downturn.

- Impact on related sectors: The tech sector correction has had a ripple effect on other sectors, further contributing to the overall market slump. This highlights the importance of market diversification and considering long-term investment strategies.

Positive Returns in Emerging Markets

While the US market struggles, several emerging markets have shown positive returns. This presents compelling opportunities for investors.

Diversification Benefits

Emerging markets offer significant diversification benefits compared to the volatile US market.

- Reduced correlation with US equities: Emerging markets often have lower correlations with US equities, meaning their performance is less directly linked to the US market's fluctuations.

- Potential for higher returns: Emerging markets often offer the potential for higher returns, although with increased risk. This potential stems from faster economic growth in many emerging economies.

- Risk mitigation strategies: Investing in emerging markets can help mitigate portfolio risk by reducing overall volatility. Effective portfolio optimization often includes a strategic allocation to emerging markets.

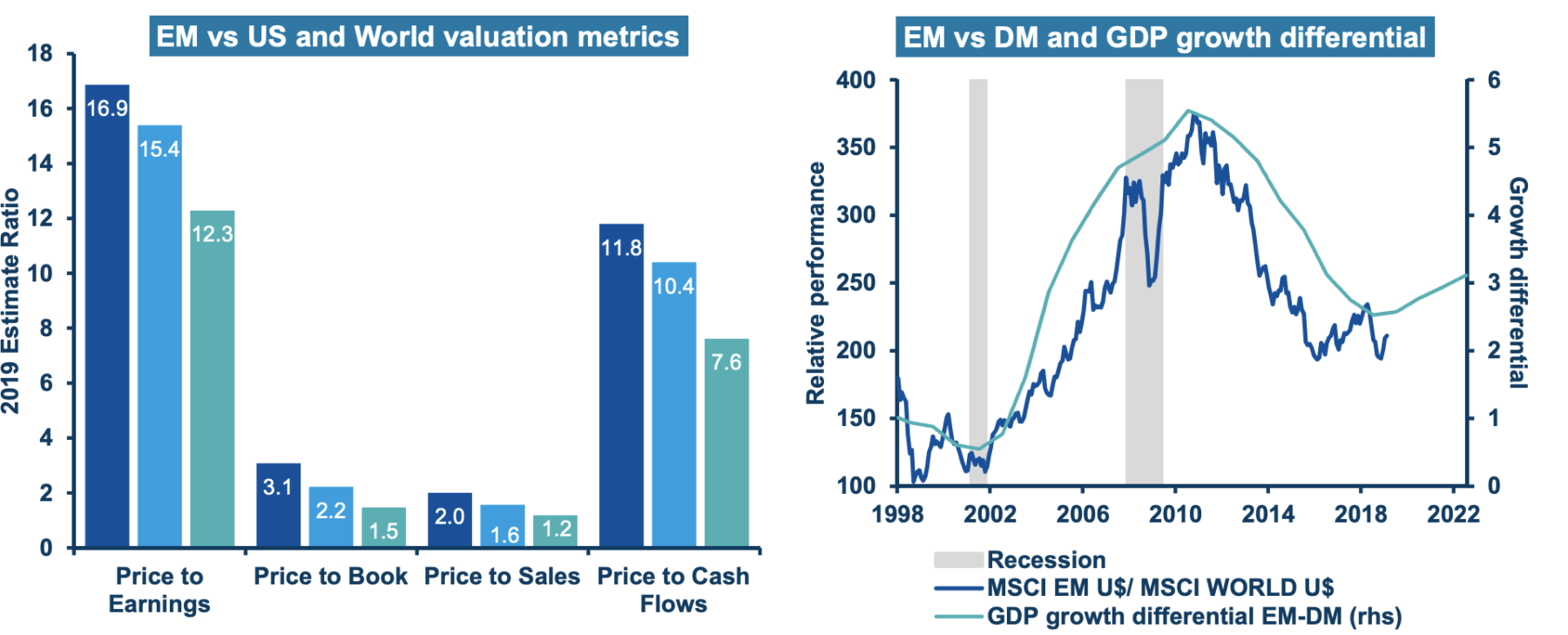

Stronger Economic Growth in Some Emerging Markets

Several emerging economies are demonstrating robust growth, outperforming developed markets.

- India: India's economy has shown remarkable resilience, driven by strong domestic demand and a relatively young population. Its GDP growth consistently outpaces many developed nations.

- Southeast Asia: Several Southeast Asian nations, such as Vietnam and Indonesia, are experiencing strong economic growth, fueled by rising middle classes and increasing foreign investment. Analyzing economic indicators for these nations reveals compelling investment opportunities.

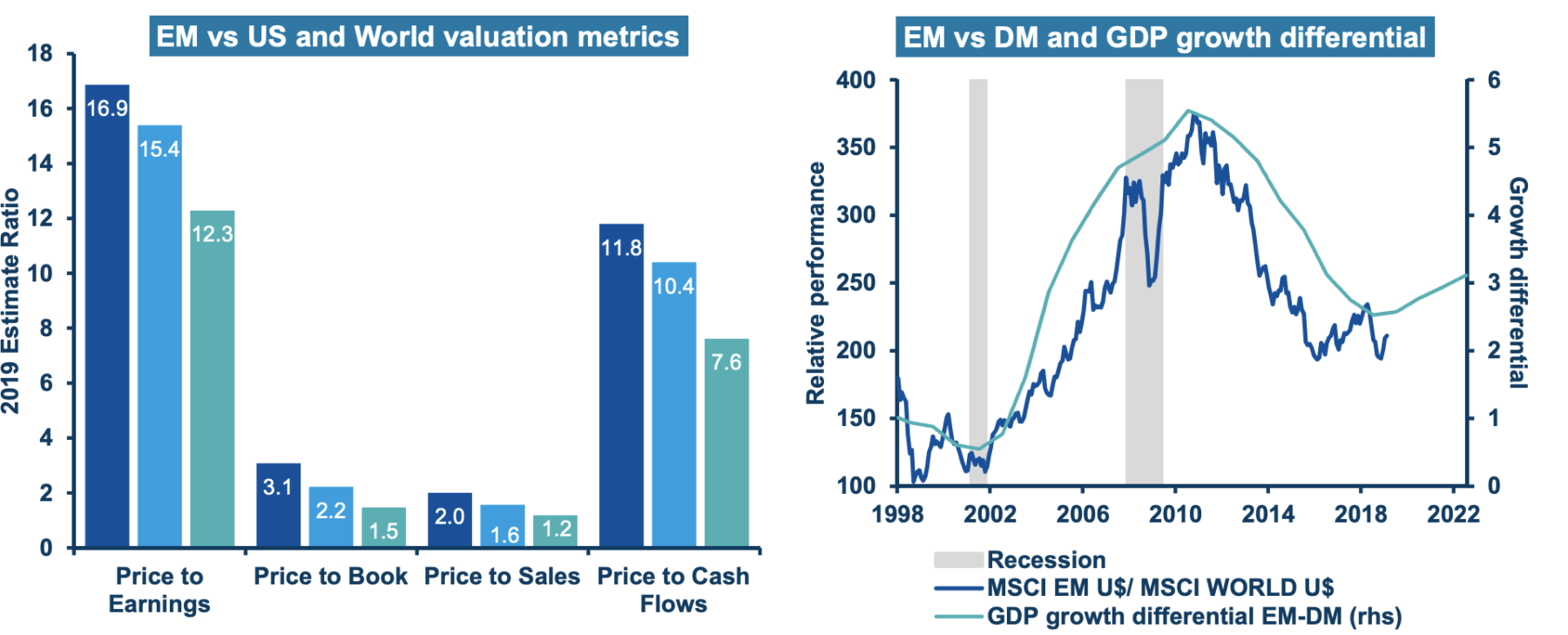

Attractive Valuations

Assets in some emerging markets may be undervalued compared to their developed market counterparts.

- Lower P/E ratios: Emerging market companies often trade at lower price-to-earnings (P/E) ratios, suggesting potentially higher future returns.

- Undervalued assets: The current market conditions might present opportunities to acquire undervalued assets in emerging markets with significant long-term growth potential. This presents an argument for focusing on long-term growth potential rather than short-term market fluctuations.

Challenges and Risks of Investing in Emerging Markets

Despite the opportunities, investing in emerging markets presents challenges and risks.

Political and Economic Instability

Political and economic instability is inherent in many emerging markets.

- Currency fluctuations: Currency fluctuations can significantly impact returns on investments in emerging markets.

- Regulatory changes: Changes in government regulations can create uncertainty and affect investment returns.

- Political risk: Political instability and corruption can pose significant risks to investments. Conducting a thorough political risk assessment is crucial before investing.

Liquidity Concerns

Liquidity can be a concern in some emerging markets.

- Lower trading volumes: Lower trading volumes compared to developed markets can make it more difficult to buy or sell assets quickly.

- Information access: Accessing reliable information about companies and markets can be challenging in some emerging markets.

- Illiquidity risk: This can result in difficulty exiting investments when desired, potentially leading to significant losses.

Regulatory Hurdles

Navigating regulatory hurdles can be complex for foreign investors.

- Tax implications: Tax laws and regulations can vary significantly across emerging markets, creating complexities for foreign investors.

- Capital controls: Some emerging markets impose restrictions on the movement of capital, limiting investors' ability to freely transfer funds.

- Bureaucratic processes: Bureaucratic processes can be slow and cumbersome, making it difficult to establish and operate businesses in some emerging markets. Understanding emerging market regulations is vital for successful foreign investment and ensuring compliance.

Conclusion

While the US market slump presents considerable challenges, the positive returns in specific emerging markets highlight opportunities for diversification and potentially higher returns. However, investors should carefully weigh the associated risks, including political instability, liquidity issues, and regulatory hurdles. Thorough due diligence and a well-defined emerging markets investment strategy are critical for navigating these complexities. By understanding these dynamics, investors can make informed decisions to capitalize on the potential of emerging markets while mitigating inherent risks. Consider exploring diverse emerging markets investment strategies to enhance your portfolio's performance and potentially achieve better long-term results.

Featured Posts

-

Spot Market For Russian Gas Eus Planned Phaseout

Apr 24, 2025

Spot Market For Russian Gas Eus Planned Phaseout

Apr 24, 2025 -

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Icu Drama And Family Conflicts

Apr 24, 2025

Bold And The Beautiful Recap April 9 Icu Drama And Family Conflicts

Apr 24, 2025 -

The Destruction Of Pope Francis Fishermans Ring Tradition And Symbolism

Apr 24, 2025

The Destruction Of Pope Francis Fishermans Ring Tradition And Symbolism

Apr 24, 2025 -

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025