Why Is Gold A Safe Haven Asset Amidst Global Trade Disputes? A Price Rally Analysis

Table of Contents

Gold's Historical Role as a Safe Haven Asset

Gold's position as a safe haven asset is deeply rooted in history. For centuries, it has been considered a store of value, independent of fluctuating fiat currencies and susceptible government policies. Unlike paper currencies prone to inflation or devaluation, gold maintains its intrinsic value, making it a dependable asset during times of economic turmoil.

Historical examples clearly demonstrate this:

- World War I and II: Gold prices soared as global economies were ravaged by conflict and uncertainty.

- The Cold War: Periods of heightened geopolitical tension saw significant increases in gold prices as investors sought safety.

- The 2008 Financial Crisis: The collapse of Lehman Brothers and the subsequent global financial meltdown triggered a dramatic rise in gold prices, as investors abandoned riskier assets in favor of the perceived security of gold.

Specific examples of historical price rallies tied to trade wars or economic sanctions:

- The Smoot-Hawley Tariff Act of 1930, which exacerbated the Great Depression, contributed to a period of increased gold demand.

- Several trade disputes during the Cold War era saw significant gold price increases as global confidence waned.

Global Trade Disputes and their Impact on Market Volatility

Global trade disputes, characterized by tariffs, sanctions, and trade wars, inject considerable uncertainty into the global economy. These actions disrupt established trade relationships, leading to:

- Increased Market Volatility: Investor confidence plummets as the future becomes unpredictable.

- Risk-Off Sentiment: Investors move away from riskier assets (stocks, bonds) towards safer havens like gold.

- Negative Impact on Global Growth: Trade barriers hinder economic growth, impacting corporate earnings and investor sentiment.

Why Investors Flock to Gold During Trade Wars

Gold's appeal as a safe haven during trade wars stems from several key factors:

- Non-Correlation with Traditional Markets: Gold's price is not directly tied to the performance of stock markets or other traditional asset classes. This makes it a valuable diversification tool in times of market stress.

- Hedge Against Inflation and Currency Devaluation: Trade wars can lead to inflationary pressures and currency fluctuations. Gold, traditionally seen as a hedge against inflation, serves as a reliable store of value during these periods.

- Psychological Safety: During times of uncertainty, investors seek tangible assets that offer a sense of security and stability. Gold, a physical asset, provides this psychological comfort.

Key differentiating factors:

- The inverse relationship between the US dollar and gold prices is noteworthy. A weaker dollar often boosts gold's appeal.

- Gold acts as a safe store of wealth, preserving purchasing power during periods of economic upheaval.

- Its tangible nature sets it apart from intangible assets, offering a unique form of security.

Analyzing the Recent Gold Price Rally in Relation to Trade Disputes

Recent gold price movements strongly correlate with the escalation of trade tensions. For example, the ongoing trade dispute between the US and China has been a major driver of gold's price increases.

Specific examples:

- [Insert date] – Escalation of tariffs led to a [percentage]% increase in gold prices within [timeframe].

- [Insert date] – Announcement of new trade sanctions resulted in a [percentage]% rise in gold prices over [timeframe]. (Include charts and graphs here to visually represent the data)

Data sources should be cited here (e.g., World Gold Council, Bloomberg, etc.).

Conclusion

The analysis clearly demonstrates gold's historical and continued role as a gold safe haven asset. Global trade disputes create economic uncertainty and market volatility, driving investors towards safer havens. Gold, with its inherent value, lack of correlation with traditional markets, and ability to hedge against inflation and currency devaluation, consistently emerges as a preferred choice. The recent gold price rally directly reflects the increased anxiety surrounding global trade tensions.

Therefore, to mitigate risks associated with global trade uncertainties and market volatility, consider investing in gold as a safe haven. Diversifying your investment portfolio with gold can provide valuable protection and stability during periods of economic instability. Gold as a safe haven investment is a strategy worth considering in today's uncertain global landscape.

Featured Posts

-

Investing In The Future The Potential Of Chinese Automakers

Apr 26, 2025

Investing In The Future The Potential Of Chinese Automakers

Apr 26, 2025 -

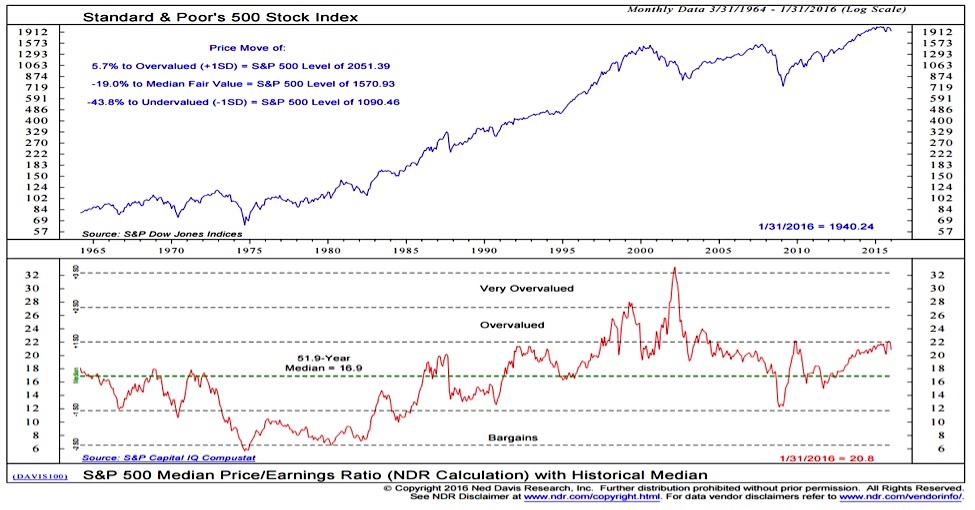

Understanding Stock Market Valuations A Bof A Informed View

Apr 26, 2025

Understanding Stock Market Valuations A Bof A Informed View

Apr 26, 2025 -

Wildfire Betting A Disturbing Trend In Los Angeles

Apr 26, 2025

Wildfire Betting A Disturbing Trend In Los Angeles

Apr 26, 2025 -

Worlds Fourth Largest Economy Californias Economic Success Story

Apr 26, 2025

Worlds Fourth Largest Economy Californias Economic Success Story

Apr 26, 2025 -

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 26, 2025

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 26, 2025