Analyzing The Bitcoin (BTC) Climb: Trade And Monetary Policy Implications

Table of Contents

The recent surge in Bitcoin's price, a remarkable Bitcoin (BTC) climb, has sparked intense debate about its implications for global trade and monetary policy. This article analyzes the factors contributing to this Bitcoin (BTC) climb, exploring its potential effects on traditional financial systems and the future of digital currencies. We will examine the interplay between macroeconomic trends, investor sentiment, and regulatory developments driving this remarkable ascent, focusing on how the Bitcoin price increase impacts global economics.

H2: Macroeconomic Factors Fueling the Bitcoin (BTC) Climb:

H3: Inflation and the Search for Safe Havens:

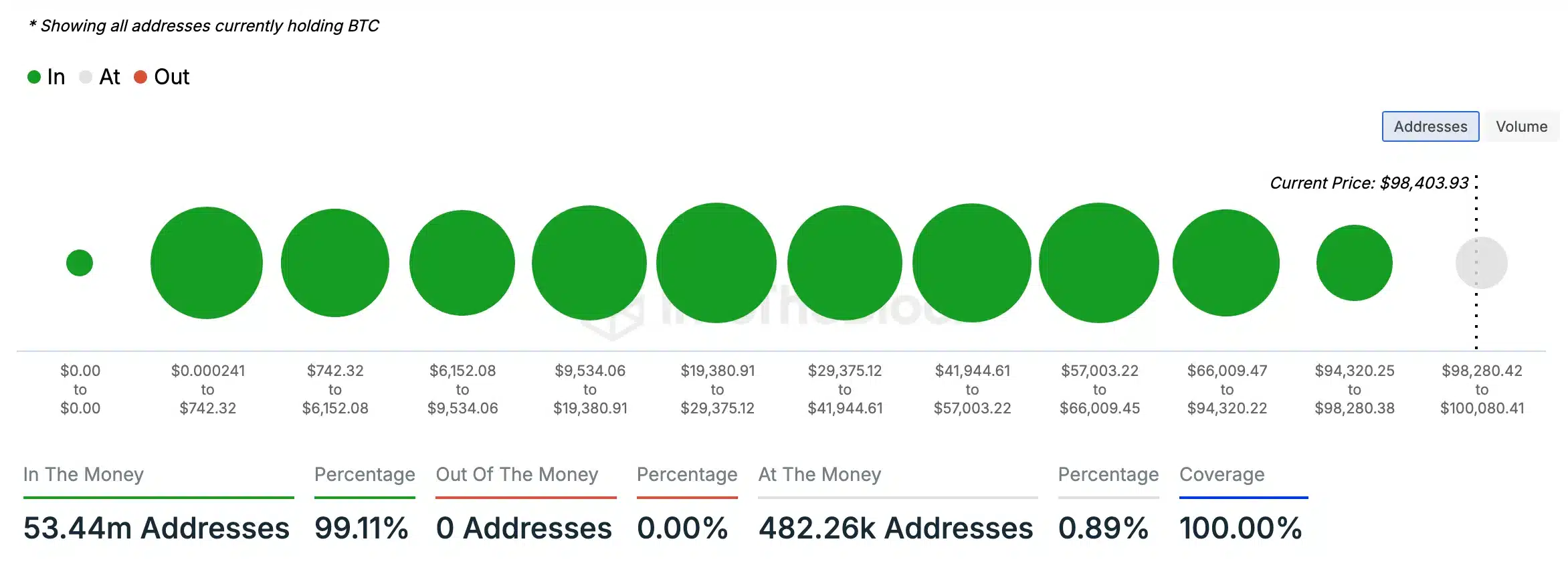

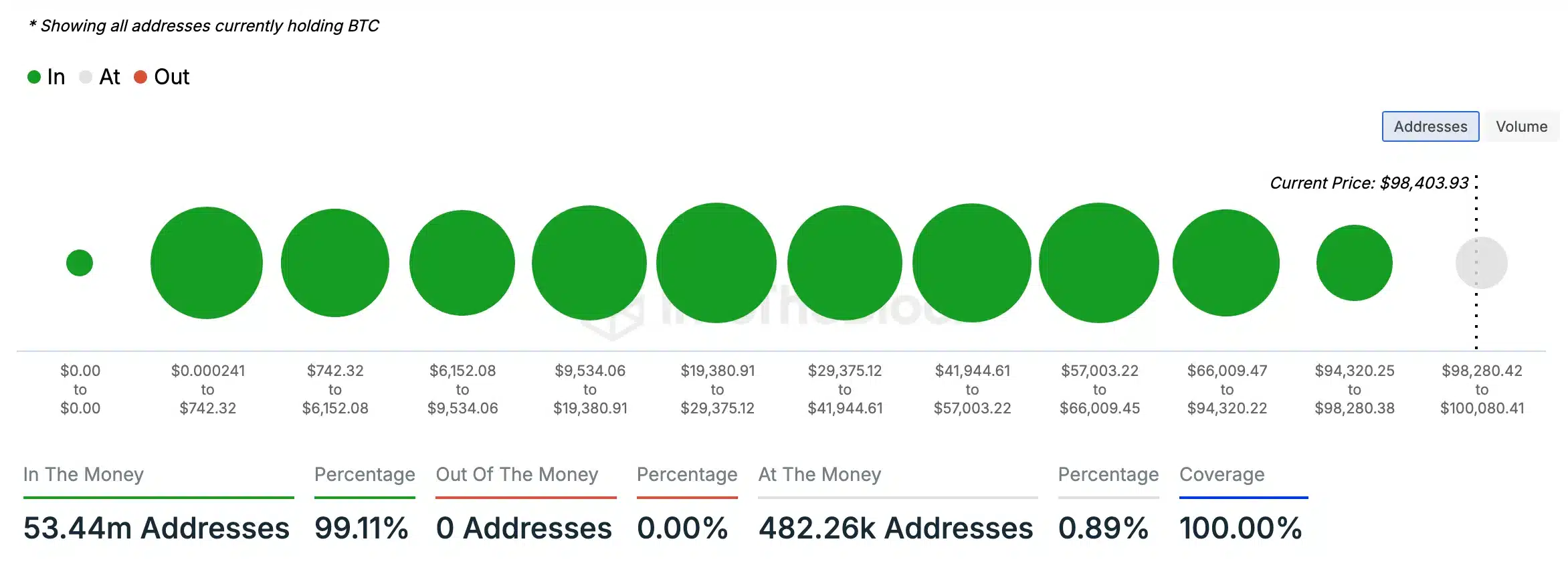

High inflation in various economies is pushing investors towards alternative assets, with Bitcoin increasingly seen as a potential hedge. Traditional assets, like bonds and even some equities, are losing value in inflationary environments, leading investors to seek stores of value perceived as less susceptible to devaluation. Bitcoin, with its fixed supply of 21 million coins, offers a compelling narrative as a finite asset in a world of expanding money supplies. This scarcity contributes to its appeal as an inflation hedge, although its inherent volatility is a key consideration.

- Increased demand for Bitcoin as an inflation hedge is evident in its price correlation with inflation indices in several countries.

- The correlation between inflation rates and Bitcoin price movements is not always straightforward, highlighting the influence of other market factors.

- Compared to other inflation hedges like gold, Bitcoin exhibits significantly higher volatility, a factor that both attracts and repels investors.

H3: Geopolitical Uncertainty and Bitcoin as a Safe Haven:

Global political instability and economic uncertainty often drive investors towards assets perceived as safe havens. Bitcoin's decentralized nature, its independence from government control, and its accessibility make it attractive during times of turmoil. When trust in traditional financial systems erodes, investors often seek alternatives, and Bitcoin's resilience to geopolitical events contributes to its appeal.

- Examples of geopolitical events impacting Bitcoin's price include the Russian invasion of Ukraine and escalating US-China tensions.

- Bitcoin's appeal as a decentralized store of value is enhanced by its lack of central authority, making it relatively immune to government seizures or sanctions.

- Compared to traditional assets like government bonds, Bitcoin often displays different performance patterns during geopolitical crises, sometimes showing resilience while others decline.

H2: Monetary Policy and its Influence on the Bitcoin (BTC) Climb:

H3: Quantitative Easing and its Impact on Bitcoin:

Expansionary monetary policies, such as quantitative easing (QE), implemented by central banks to stimulate economic growth, can indirectly boost Bitcoin's price. QE involves increasing the money supply, which can lead to currency devaluation and inflation. This devaluation makes alternative assets, including Bitcoin, relatively more attractive.

- A strong correlation between quantitative easing programs and Bitcoin price increases has been observed in historical data.

- Bitcoin’s role as a potential alternative to fiat currency is supported by its limited supply and its independence from central bank policies.

- Analyzing the long-term effects of monetary policy on Bitcoin adoption requires examining the evolution of both monetary policy and the cryptocurrency market.

H3: Interest Rate Hikes and their Effect on Bitcoin Investment:

Changes in interest rates significantly impact investor decisions. Higher interest rates typically increase the attractiveness of traditional, interest-bearing assets, potentially drawing investment away from Bitcoin. Conversely, lower interest rates can make Bitcoin a more appealing alternative.

- Analyzing Bitcoin's price behavior during periods of rising interest rates reveals a complex relationship, with both positive and negative correlations observed depending on other market factors.

- Compared to traditional investments like bonds, Bitcoin's returns during interest rate changes exhibit significantly higher volatility but can also offer potentially higher rewards.

- The risk-reward profile of Bitcoin investment in a high-interest-rate environment necessitates careful consideration of its volatility versus the relatively stable returns of traditional, interest-bearing assets.

H2: Trade and the Growing Adoption of Bitcoin (BTC):

H3: Bitcoin's Role in Cross-Border Payments:

Bitcoin can facilitate faster and cheaper cross-border transactions compared to traditional banking systems, making it attractive for international trade and remittances. Its decentralized nature bypasses traditional banking intermediaries, reducing processing times and fees.

- Case studies of Bitcoin's usage in cross-border payments illustrate its potential to revolutionize international finance.

- Advantages of using Bitcoin for international trade include speed, lower costs, and reduced reliance on traditional financial institutions; however, limitations remain, including volatility and regulatory uncertainties.

- A comparison of transaction costs with traditional SWIFT transfers shows that Bitcoin can offer significant savings, especially for smaller transactions.

H3: Bitcoin's Impact on Emerging Markets:

Bitcoin can offer financial inclusion to unbanked populations in developing countries. Traditional banking systems often lack the reach and accessibility required to serve the needs of these populations. Bitcoin offers an alternative pathway to financial participation.

- Examples of Bitcoin's use in emerging markets show its potential to empower individuals and businesses previously excluded from traditional financial services.

- Bitcoin's potential for financial innovation in developing countries includes facilitating microtransactions, peer-to-peer lending, and access to global markets.

- Challenges related to regulation, infrastructure (internet access and electricity), and technological literacy must be addressed to fully realize Bitcoin's potential in these markets.

Conclusion:

The recent Bitcoin (BTC) climb is multifaceted, driven by macroeconomic factors, monetary policy decisions, and evolving global trade dynamics. Understanding these interwoven elements is crucial. The increasing adoption of Bitcoin as a store of value, an inflation hedge, and a facilitator of international payments highlights its growing influence. While volatility persists, its long-term potential warrants attention. To stay informed about the ongoing implications of this Bitcoin (BTC) climb, continue researching and analyzing market trends. Further analysis of the Bitcoin (BTC) climb and its ramifications is essential for navigating the evolving digital asset market.

Featured Posts

-

Nba All Star Game 2024 Notable Additions Include Green Moody And Hield

Apr 24, 2025

Nba All Star Game 2024 Notable Additions Include Green Moody And Hield

Apr 24, 2025 -

Dollar Rises Trumps Softer Tone On Fed Boosts Usd Value Against Major Peers

Apr 24, 2025

Dollar Rises Trumps Softer Tone On Fed Boosts Usd Value Against Major Peers

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Usd Gains Momentum Trumps Change In Tone Impacts Dollars Performance Against Major Currencies

Apr 24, 2025

Usd Gains Momentum Trumps Change In Tone Impacts Dollars Performance Against Major Currencies

Apr 24, 2025 -

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025