Assessing The Risks: Trump's Trade Offensive And US Financial Dominance

Table of Contents

The Trump Trade War: A Protectionist Approach

The core of the Trump administration's economic strategy was a protectionist approach, manifested in a series of tariffs and trade restrictions aimed at reshaping global trade relationships in favor of the United States. This section delves into the specifics of these policies and their far-reaching consequences.

Tariffs and Trade Restrictions

The Trump administration implemented significant tariffs on various imported goods, significantly impacting global trade flows. These tariffs, often levied under the guise of national security concerns, targeted key trading partners and specific industries.

- 25% tariff on steel imports from China: This tariff aimed to protect the domestic steel industry but led to retaliatory tariffs from China and increased costs for US manufacturers.

- 10% tariff on aluminum imports from various countries: Similar to the steel tariffs, this measure aimed to bolster domestic aluminum production, but it triggered reciprocal tariffs and disrupted global supply chains.

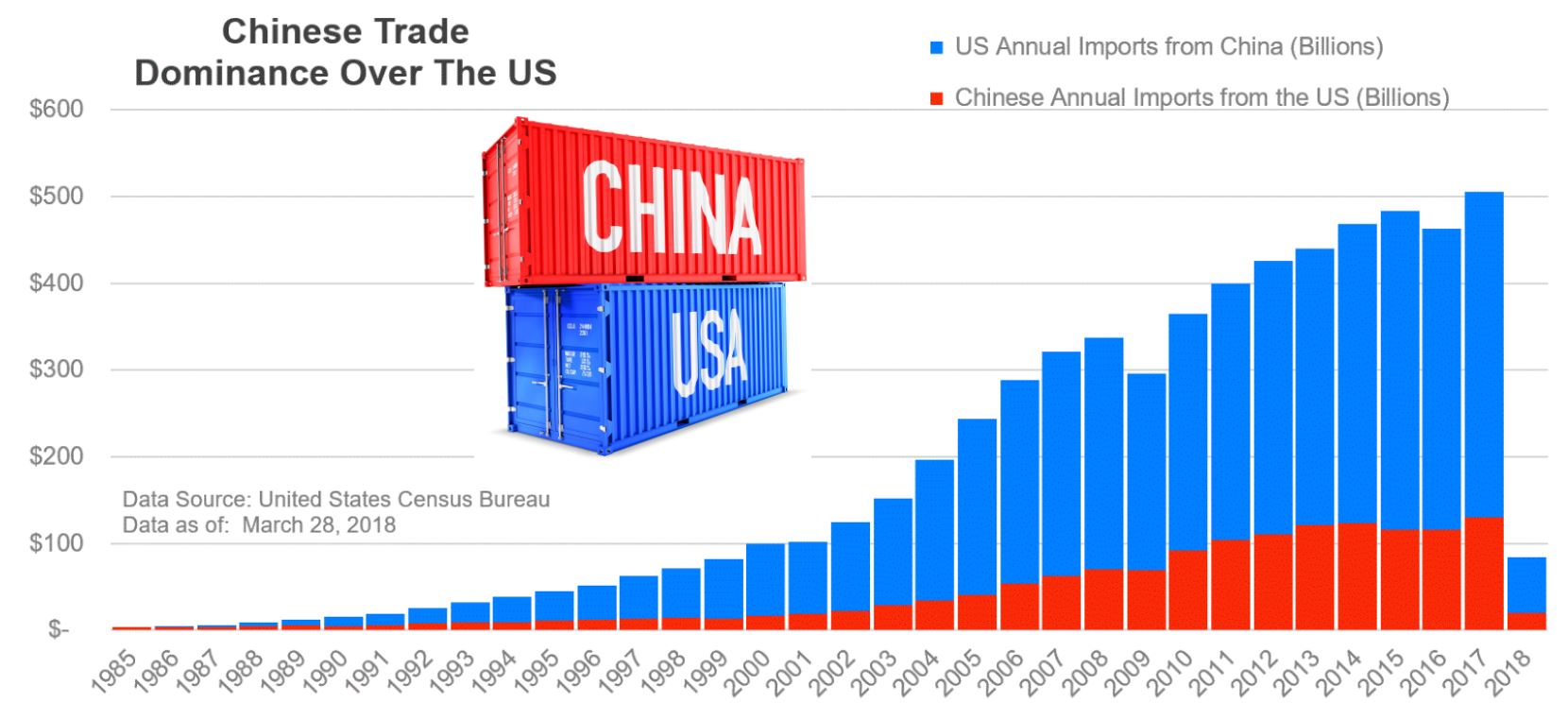

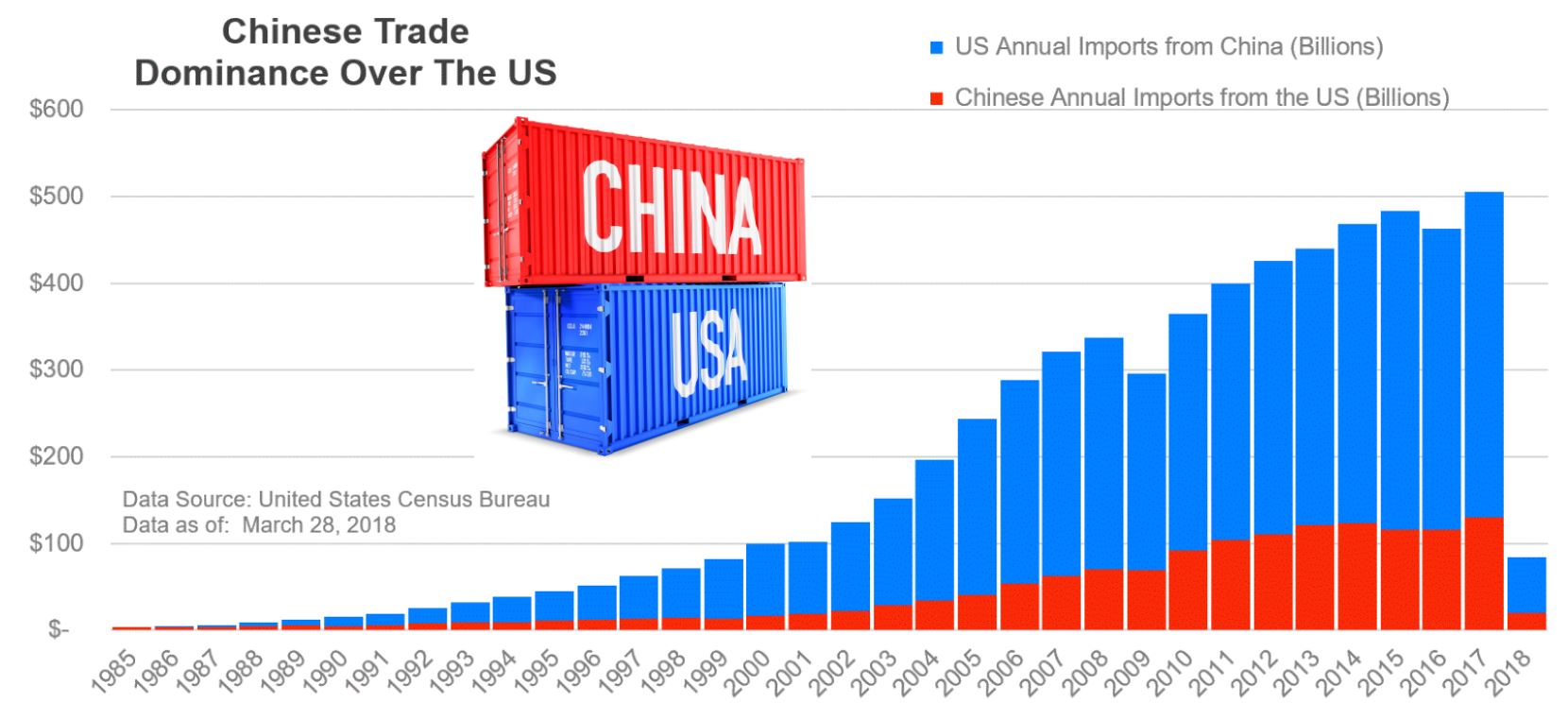

- Tariffs on Chinese goods: A wide range of goods imported from China faced tariffs, escalating tensions and leading to a significant trade war between the two economic superpowers. These tariffs covered sectors from consumer electronics to agricultural products.

- Retaliatory tariffs imposed by other nations: The US tariffs provoked retaliatory measures from countries like China, the European Union, and Canada, creating a cycle of escalating trade tensions and harming global trade.

Negotiating Leverage and its Limitations

The Trump administration employed aggressive negotiating tactics, aiming to secure better trade deals for the US. However, the effectiveness of these tactics remains a subject of debate.

- USMCA negotiations and their impact on North American trade: While the USMCA (United States-Mexico-Canada Agreement) replaced NAFTA, the negotiations were contentious and resulted in only minor changes to the original agreement.

- Trade disputes with China and their economic repercussions: The trade war with China significantly disrupted global supply chains, impacting businesses and consumers worldwide. The economic repercussions included increased prices, reduced trade volumes, and uncertainty in global markets.

- Impact on the World Trade Organization (WTO) and multilateral trade agreements: The Trump administration's protectionist stance and challenges to the WTO's authority weakened the multilateral trading system and undermined international cooperation on trade issues.

Impact on US Financial Dominance

The Trump administration's trade policies posed significant risks to the long-term stability and dominance of the US dollar in the global financial system. This section explores these threats in detail.

The US Dollar's Global Reserve Currency Status

The US dollar's status as the world's primary reserve currency is inextricably linked to the stability and predictability of the US economy and its role in global trade. The trade war undermined this stability in several ways.

- Increased reliance on alternative currencies: The uncertainty created by the trade wars prompted some countries to diversify their foreign exchange reserves, reducing the reliance on the US dollar.

- Reduced US influence in global finance: The erratic nature of the trade policies diminished confidence in the predictability of US economic policy, potentially affecting the dollar's standing as the preferred currency for international transactions.

- Higher borrowing costs for the US: The trade disputes and resulting economic uncertainty could lead to increased borrowing costs for the US government, impacting its fiscal position.

Global Investment Flows and Capital Markets

The trade war created considerable uncertainty in global markets, significantly impacting investment flows and capital markets.

- Reduced foreign direct investment in the US: The unpredictable nature of the trade policies deterred foreign investors, reducing foreign direct investment in the US economy.

- Increased volatility in global financial markets: The trade disputes and retaliatory tariffs contributed to heightened volatility in global financial markets, making it more challenging for businesses to plan and invest.

- Negative impact on investor confidence: The uncertainty and instability created by the trade war eroded investor confidence, leading to capital flight and reduced investment.

Geopolitical Implications

The Trump administration's protectionist trade policies had significant geopolitical consequences, affecting US relationships with key allies and partners.

- Strained relations with the European Union and Canada: The imposition of tariffs on steel and aluminum imports from these countries strained transatlantic and North American relationships.

- Increased tensions with China: The trade war with China significantly increased geopolitical tensions between the two superpowers, impacting global security and international cooperation.

- Weakening of multilateral institutions: The Trump administration's disregard for multilateral institutions like the WTO weakened the global governance framework for trade and international cooperation.

Conclusion

This analysis demonstrates that Trump's trade offensive presented significant risks to US financial dominance. The imposition of tariffs, coupled with aggressive negotiating tactics, created uncertainty in global markets and strained international relations. While some short-term gains might have been achieved in specific sectors, the long-term consequences, including damage to the US dollar's global standing and increased geopolitical instability, outweigh any perceived benefits. Further research is crucial to fully understand the lasting impact of these policies. Understanding the complexities of assessing the risks associated with such aggressive trade policies is vital for developing effective strategies for maintaining US financial leadership in the future. We must continue to critically assess the risks of protectionist policies and their impact on global economic stability. A thorough understanding of the risks inherent in protectionist trade policies is paramount for informed decision-making in the future.

Featured Posts

-

Across The Us Citizens Rally Against Trump

Apr 22, 2025

Across The Us Citizens Rally Against Trump

Apr 22, 2025 -

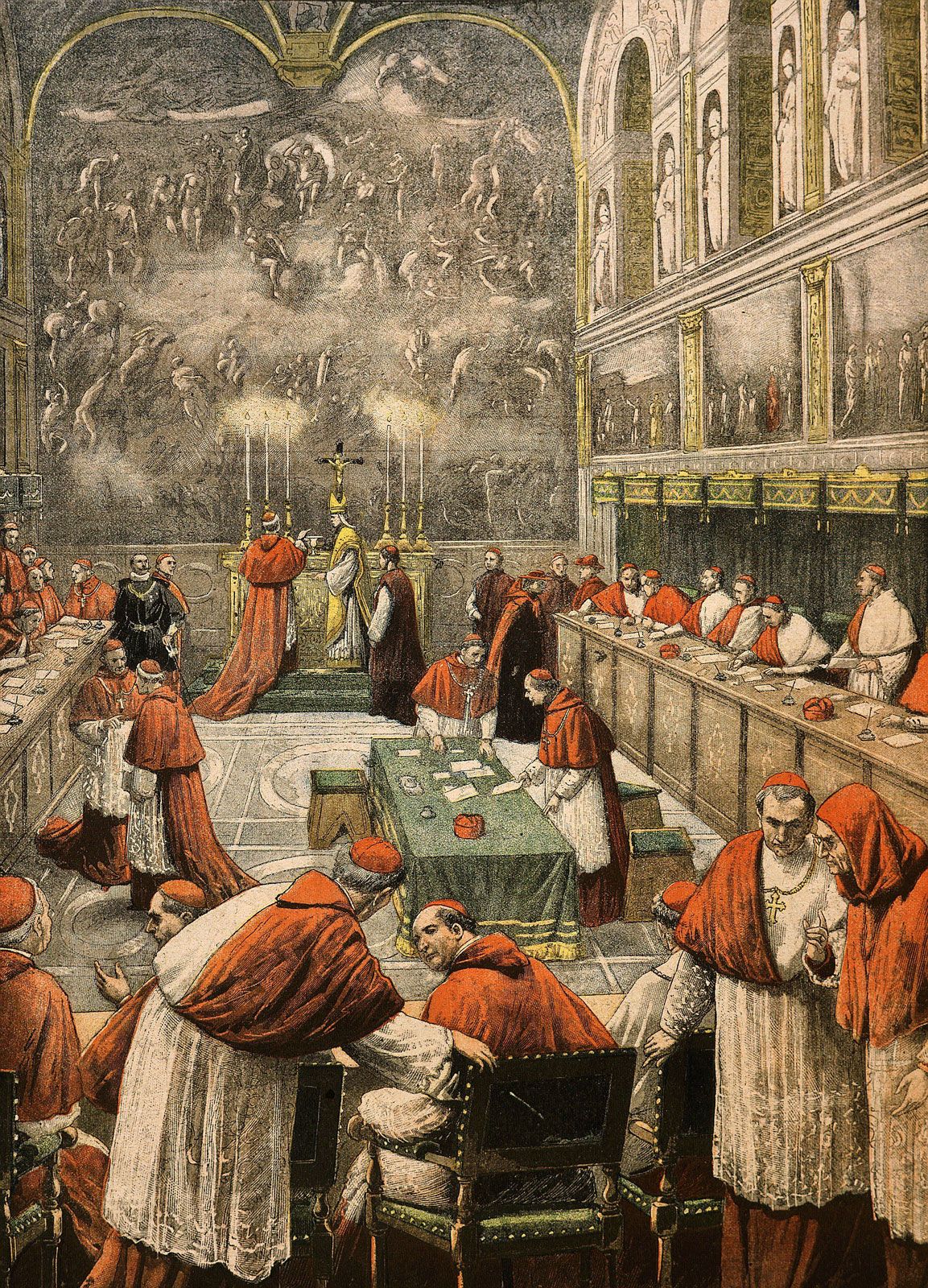

Understanding Papal Conclaves History Secrecy And The Election Of The Pope

Apr 22, 2025

Understanding Papal Conclaves History Secrecy And The Election Of The Pope

Apr 22, 2025 -

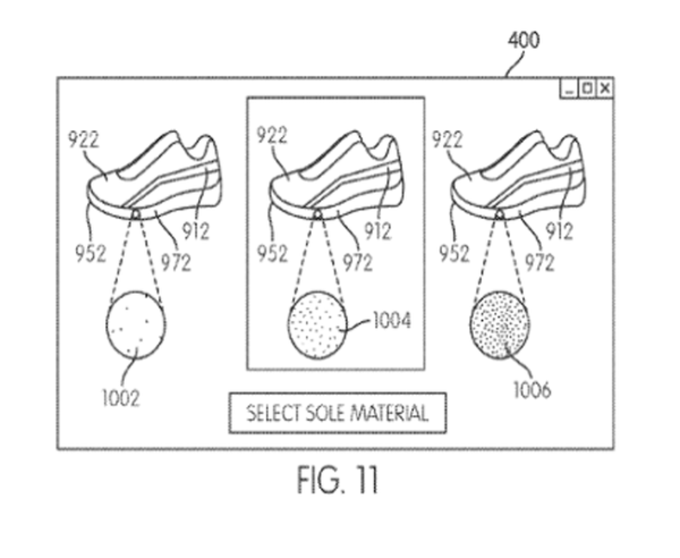

The Complexities Of Automated Nike Sneaker Manufacturing

Apr 22, 2025

The Complexities Of Automated Nike Sneaker Manufacturing

Apr 22, 2025 -

Strengthening Bilateral Security Recent Developments Between China And Indonesia

Apr 22, 2025

Strengthening Bilateral Security Recent Developments Between China And Indonesia

Apr 22, 2025 -

Dollar Slides Amidst Trade Tensions Stock Market Live Updates

Apr 22, 2025

Dollar Slides Amidst Trade Tensions Stock Market Live Updates

Apr 22, 2025