China Diversifies LPG Sources: Middle East Replaces US Amid Trade Tensions

Table of Contents

Declining US LPG Exports to China

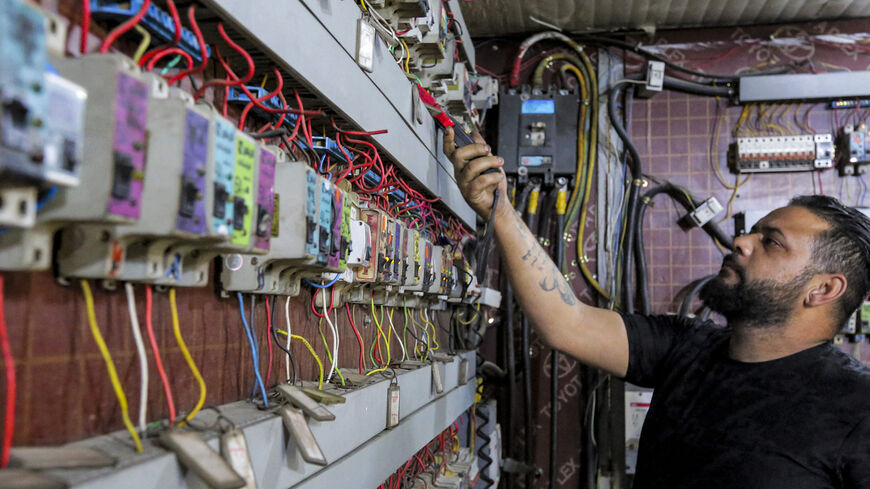

The decline in US LPG exports to China is a direct consequence of escalating trade tensions between the two nations.

Impact of Trade Wars

The US-China trade war, characterized by reciprocal tariffs and trade restrictions, significantly impacted LPG trade.

- Specific examples of tariffs imposed: Tariffs imposed on various goods, including petrochemical products, increased the cost of US LPG for Chinese importers, making it less competitive.

- Resulting price increases for Chinese importers: These tariffs resulted in substantial price increases, rendering US LPG less attractive compared to alternatives.

- Alternative suppliers explored: Facing higher costs and uncertainty, Chinese importers actively sought alternative LPG suppliers, leading to a surge in imports from the Middle East.

- Statistics on the decline in US LPG exports to China: Data from [cite a reliable source, e.g., EIA, BP Statistical Review] shows a [quantify the percentage] decrease in US LPG exports to China between [year] and [year].

Shifting Geopolitical Dynamics

Beyond the immediate impact of trade wars, broader geopolitical considerations fueled China's decision to diversify its LPG sources.

- US domestic energy policies: Changes in US domestic energy policies, including increased focus on domestic consumption, impacted the availability of LPG for export.

- China's desire to reduce reliance on a single supplier: China’s pursuit of energy security emphasizes reducing over-reliance on any single supplier to mitigate geopolitical risks.

- The search for more stable supply chains: The volatility inherent in the US-China relationship prompted China to seek more stable and predictable supply chains for its energy needs.

The Rise of Middle Eastern LPG Suppliers

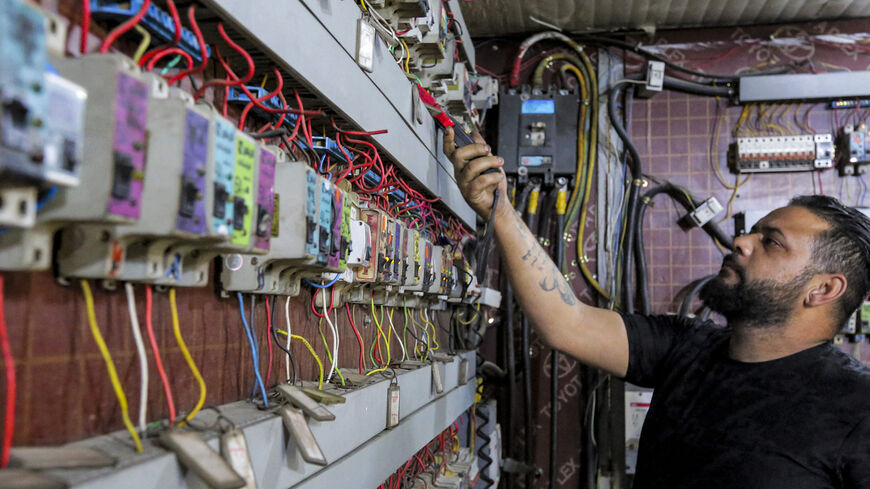

The decline in US LPG imports has been directly offset by a substantial increase in supplies from the Middle East.

Increased Imports from the Middle East

Middle Eastern countries, particularly Saudi Arabia, Qatar, and the UAE, have become major LPG suppliers to China.

- Quantify the growth in imports from these countries: Data from [cite reliable sources] indicates a [quantify the percentage] increase in LPG imports from the Middle East to China between [year] and [year].

- Discuss infrastructural developments: Significant investments in new pipelines, port facilities, and storage infrastructure have facilitated this increased flow of LPG from the Middle East to China.

Advantages of Middle Eastern LPG

Several factors make Middle Eastern LPG an attractive alternative to US supplies for China.

- Competitive pricing: Middle Eastern LPG often offers more competitive pricing due to lower production costs and different market dynamics.

- Geographical proximity: The closer proximity of Middle Eastern sources reduces shipping costs and transit times, improving efficiency and reliability.

- Potentially more stable political relations: Compared to the fluctuating US-China relationship, China may perceive its relations with several Middle Eastern nations as more stable and predictable.

Implications for the Global LPG Market

China's strategic diversification has far-reaching implications for the global LPG landscape.

Increased Competition

The influx of Middle Eastern LPG into the market has intensified competition among global suppliers.

- Impact on market prices: Increased supply has put downward pressure on global LPG prices, benefitting consumers worldwide.

- Strategies of other LPG exporting nations: Other LPG-exporting countries are adapting their strategies to maintain competitiveness in this evolving market.

- Potential for new partnerships and trade agreements: China’s shift is fostering new partnerships and trade agreements between China and Middle Eastern energy producers.

Energy Security for China

This diversification substantially enhances China's energy security.

- Reduced reliance on a single supplier: The shift reduces China’s dependence on a single major supplier, mitigating risks associated with geopolitical instability.

- Better geographic diversification of energy sources: China's energy mix is now more geographically diverse, enhancing resilience to disruptions in any one region.

- Improved resilience against geopolitical disruptions: The diversification strategy makes China's energy supply less vulnerable to disruptions stemming from political tensions or unexpected events.

Conclusion

China's strategic shift away from US LPG imports and towards Middle Eastern suppliers signifies a pivotal moment in the global energy market. Fueled by trade tensions and a commitment to energy security, this diversification has profound consequences for both China and its international trading partners. The heightened competition and emerging trade relationships will continue to shape the global LPG landscape in the years to come. Understanding the complexities of China LPG imports is critical for businesses and policymakers navigating this dynamic energy market. Stay informed on the evolving dynamics of China's LPG sourcing to effectively adapt to this rapidly changing landscape.

Featured Posts

-

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 24, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 24, 2025 -

Chainalysis Acquires Ai Startup Alterya Expanding Blockchain Capabilities

Apr 24, 2025

Chainalysis Acquires Ai Startup Alterya Expanding Blockchain Capabilities

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Fight For Survival

Apr 24, 2025 -

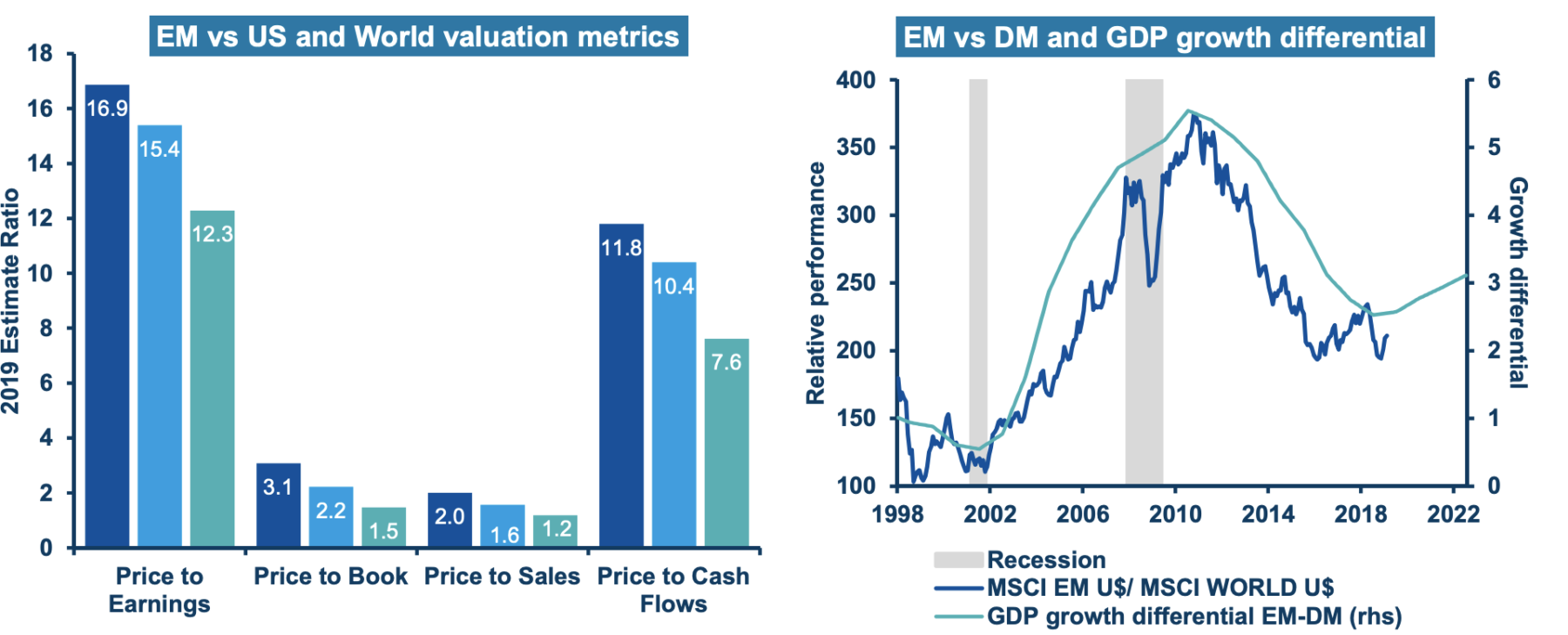

Stock Market Valuation Concerns Bof A Offers A Balanced View

Apr 24, 2025

Stock Market Valuation Concerns Bof A Offers A Balanced View

Apr 24, 2025 -

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025