Chinese Buyout Firm Mulls Disposal Of UTAC

Table of Contents

Reasons Behind the Potential UTAC Disposal

Golden Dragon Capital's reported consideration of UTAC's disposal likely stems from a confluence of factors. The decision may be driven by financial pressures, a strategic reassessment of their portfolio, or a desire to focus on core business areas.

-

Financial Performance: UTAC's recent financial performance might have fallen short of Golden Dragon Capital's expectations. Declining profitability, increased debt, or a failure to meet projected growth targets could trigger a decision to divest. Analyzing UTAC's financial statements, specifically revenue growth, EBITDA margins, and debt-to-equity ratios over the past few years, will reveal a clearer picture.

-

Strategic Fit: UTAC's strategic alignment with Golden Dragon Capital's overall portfolio may be lacking. The firm might be prioritizing investments in sectors exhibiting stronger growth potential or better synergies with existing holdings. This could lead them to conclude that UTAC is no longer a strategic asset worth retaining.

-

Attractive Acquisition Targets: Golden Dragon Capital may have identified more appealing acquisition targets in other sectors. Opportunities with higher growth potential, better market positioning, or stronger synergy potential could incentivize them to reallocate resources away from UTAC.

-

Market Conditions: The prevailing market conditions and industry trends within the automotive sector could also play a role. Factors such as increasing competition, technological disruptions, and economic uncertainty might influence Golden Dragon Capital's decision to divest.

Potential Buyers and Valuation of UTAC

The potential sale of UTAC is likely to attract significant interest from a range of buyers, including competitors in the automotive component manufacturing space, strategic investors seeking to expand their market share, and private equity firms looking for lucrative investment opportunities.

-

Potential Acquirers: Several companies, both domestic and international, possess the financial strength and strategic interest to acquire UTAC. This includes established automotive component manufacturers, technology companies focused on automotive solutions, and private equity firms specializing in the automotive industry.

-

Valuation of UTAC: Determining UTAC's valuation will involve a detailed financial analysis, including an assessment of its revenue streams, profitability, assets, and market position. Comparable company analysis, using publicly traded companies with similar characteristics, will help estimate a reasonable valuation range.

-

Factors Affecting Sale Price: Several factors will influence the final sale price, including UTAC’s financial performance, market conditions, the level of competition among potential buyers, and the specific terms of the deal.

Impact of the Sale on UTAC's Employees, Customers, and the Market

The potential sale of UTAC has considerable implications for its employees, customers, and the wider market.

-

Impact on Employees: The sale could lead to job losses, restructuring, or changes in employment terms. A new owner might implement different operational strategies, potentially affecting workforce size and composition.

-

Impact on Customers: Customers might experience changes in product offerings, service levels, pricing, or supply chain dynamics. A change in ownership could also affect the long-term stability and reliability of UTAC's supply to its customers.

-

Impact on Competitors: The sale will likely reshape the competitive landscape. The new owner might implement strategies that increase competition or alter market dynamics for UTAC’s competitors.

-

Overall Market Effects: The transaction could trigger further consolidation within the automotive component manufacturing sector. This might lead to increased efficiency, innovation, or potential price increases.

Timeline and Uncertainties Surrounding the UTAC Disposal

The timeline for the UTAC disposal remains uncertain. While reports suggest Golden Dragon Capital is actively exploring options, several factors could impact the process.

-

Projected Timeline: The sale process might span several months, involving due diligence, negotiation, and regulatory approvals.

-

Regulatory Approvals: Securing necessary regulatory approvals from relevant authorities will be crucial before the sale can be finalized. This could involve antitrust reviews or other compliance checks.

-

Potential Challenges and Delays: Unexpected challenges or delays might arise during the due diligence phase, negotiations, or regulatory approvals.

-

Uncertainties: The identity of the final buyer and the ultimate sale price remain uncertain until the deal is concluded.

The Future of UTAC After the Potential Sale

The potential sale of UTAC marks a significant turning point for the company, Golden Dragon Capital, and the broader automotive components market. The reasons for the potential disposal, ranging from financial underperformance to strategic realignment, will shape UTAC’s future trajectory. The identity of the new owner and the resulting changes in operations, strategy, and market positioning will determine whether the sale ultimately benefits UTAC, its stakeholders, and the wider automotive industry. The UTAC sale, or rather, the UTAC disposal process, warrants close monitoring. Stay tuned for further updates on the future of UTAC and the evolving landscape of Chinese buyout firm activity. Follow us for more insights into significant acquisitions and disposals, including developments in the UTAC sale and other key transactions involving Chinese private equity.

Featured Posts

-

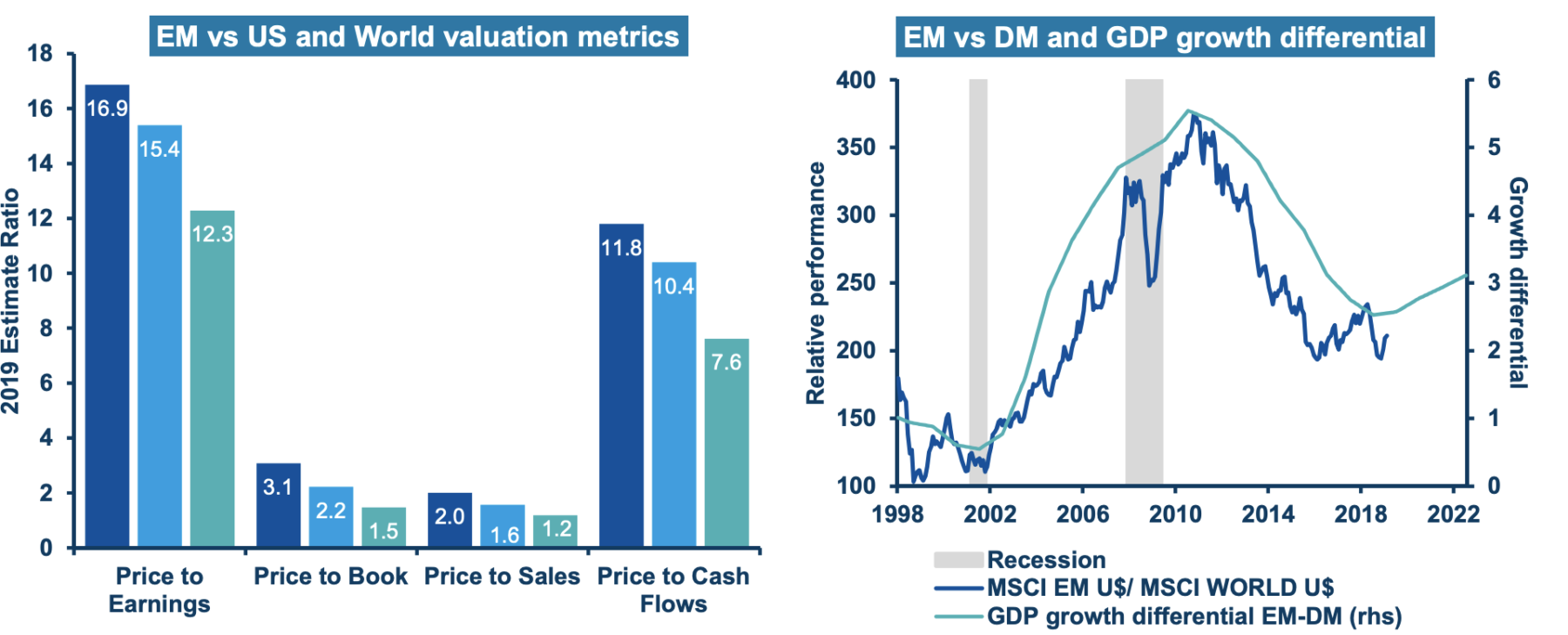

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025 -

Saudi India Energy Collaboration Two Oil Refineries In The Works

Apr 24, 2025

Saudi India Energy Collaboration Two Oil Refineries In The Works

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025 -

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025 -

Hong Kong Chinese Stocks Rally On Trade Deal Optimism

Apr 24, 2025

Hong Kong Chinese Stocks Rally On Trade Deal Optimism

Apr 24, 2025