Credit Card Industry Faces Headwinds As Consumer Spending Slows

Table of Contents

Declining Consumer Spending and its Impact

The direct correlation between slowing consumer spending and reduced credit card transactions is undeniable. As consumers tighten their belts, credit card usage naturally decreases. This decline is largely driven by several key factors: inflation, rising interest rates, and recessionary pressures. The impact on the credit card industry is significant, impacting revenue streams and profitability.

-

Reduced discretionary spending due to inflation: Soaring inflation erodes purchasing power, forcing consumers to cut back on non-essential purchases. This directly impacts credit card transactions, as discretionary spending accounts for a significant portion of credit card usage. Consumers are prioritizing essential goods and services, leaving less room for purchases made with credit cards.

-

Increased interest rates making borrowing more expensive: Higher interest rates increase the cost of borrowing, making credit cards a less attractive option for financing purchases. Consumers are less likely to use credit cards when the cost of carrying a balance is significantly higher. This leads to a decrease in both the volume and value of credit card transactions.

-

Growing consumer debt burden limiting spending capacity: Many consumers already carry significant levels of credit card debt. Rising interest rates exacerbate this problem, making it more difficult to manage existing debt and limiting their capacity for additional borrowing. This restricts their ability to make new purchases using credit cards.

-

Fear of recession impacting consumer confidence and spending habits: The looming threat of a recession further dampens consumer confidence. Uncertainty about job security and future income leads consumers to adopt a more cautious approach to spending, reducing their reliance on credit cards.

Rising Credit Card Debt and Delinquency Rates

The decline in consumer spending is accompanied by a troubling trend: increasing levels of credit card debt and rising delinquency rates. This creates a significant risk for the credit card industry, potentially leading to increased losses and impacting profitability.

-

Higher minimum payments due to increased interest rates: As interest rates climb, minimum payments on credit card balances increase significantly. This makes it more challenging for consumers to manage their debt, increasing the likelihood of delinquency.

-

Difficulty in managing multiple credit card balances: Many consumers juggle multiple credit cards, making it difficult to track payments and stay on top of their balances. This complexity can easily lead to missed payments and increasing debt.

-

Increased reliance on credit cards due to financial strain: Facing financial strain, some consumers may increasingly rely on credit cards to cover essential expenses. This can quickly lead to an unsustainable level of debt, increasing delinquency rates.

-

Potential for higher default rates and increased losses for lenders: If delinquency rates continue to rise, the credit card industry will inevitably face higher default rates. This means lenders will experience increased losses, impacting the overall financial health of the industry.

The Fintech Disruption and its Influence

The traditional credit card industry is facing increasing competition from fintech companies and innovative payment solutions. Buy Now Pay Later (BNPL) services, in particular, are disrupting the landscape, offering alternative payment options that challenge the dominance of credit cards.

-

Increased competition from BNPL services and other digital payment platforms: Fintech companies are offering more convenient and often cheaper alternatives to traditional credit cards. This intensifies competition, forcing credit card companies to innovate and adapt.

-

Pressure on credit card companies to offer lower fees and better customer experiences: To remain competitive, credit card companies are under pressure to reduce fees and improve customer experiences. This requires investment in technology and customer service.

-

Technological innovation driving changes in payment processing and customer interaction: Fintech is driving technological innovation in payment processing, offering faster, more secure, and more seamless transactions. Credit card companies must keep pace with these advancements to stay relevant.

-

The potential for fintech to disrupt the credit card industry's dominance: The rapid growth and innovation in the fintech sector pose a significant threat to the long-term dominance of the traditional credit card industry.

Adapting to the Changing Landscape

To navigate these challenges, credit card companies are adopting several strategies:

-

Robust risk management strategies: Credit card companies are refining their risk assessment models to better identify and manage the increasing risk of defaults. This includes enhanced credit scoring and more rigorous underwriting processes.

-

Focusing on customer loyalty programs: Building and maintaining strong customer loyalty is crucial. Attractive loyalty programs, personalized offers, and excellent customer service can help retain existing customers and attract new ones.

-

Investing in innovative technologies: Credit card companies must invest in new technologies to improve efficiency, enhance security, and offer a superior customer experience. This includes embracing AI-powered fraud detection systems and developing innovative payment solutions.

-

Strategic partnerships with fintech companies: Collaboration with fintech companies can provide access to new technologies and innovative payment solutions, helping traditional credit card companies remain competitive.

Conclusion

The credit card industry is undeniably facing significant headwinds as consumer spending slows. Rising debt levels, increased competition from fintech, and a challenging economic climate are all contributing factors. The industry needs to adapt quickly to these changes through innovation, improved risk management, and a renewed focus on customer loyalty. Understanding the challenges facing the credit card industry is crucial for both businesses and consumers. Stay informed about the latest trends in consumer spending and credit card usage to navigate this dynamic economic landscape effectively. Learn more about how the credit card industry is adapting and protecting itself against these headwinds.

Featured Posts

-

Trump Immigration Policies Meet Significant Legal Resistance

Apr 24, 2025

Trump Immigration Policies Meet Significant Legal Resistance

Apr 24, 2025 -

My Honest Review Of The Lg C3 77 Inch Oled Tv

Apr 24, 2025

My Honest Review Of The Lg C3 77 Inch Oled Tv

Apr 24, 2025 -

Herro Edges Hield In Thrilling Nba 3 Point Contest

Apr 24, 2025

Herro Edges Hield In Thrilling Nba 3 Point Contest

Apr 24, 2025 -

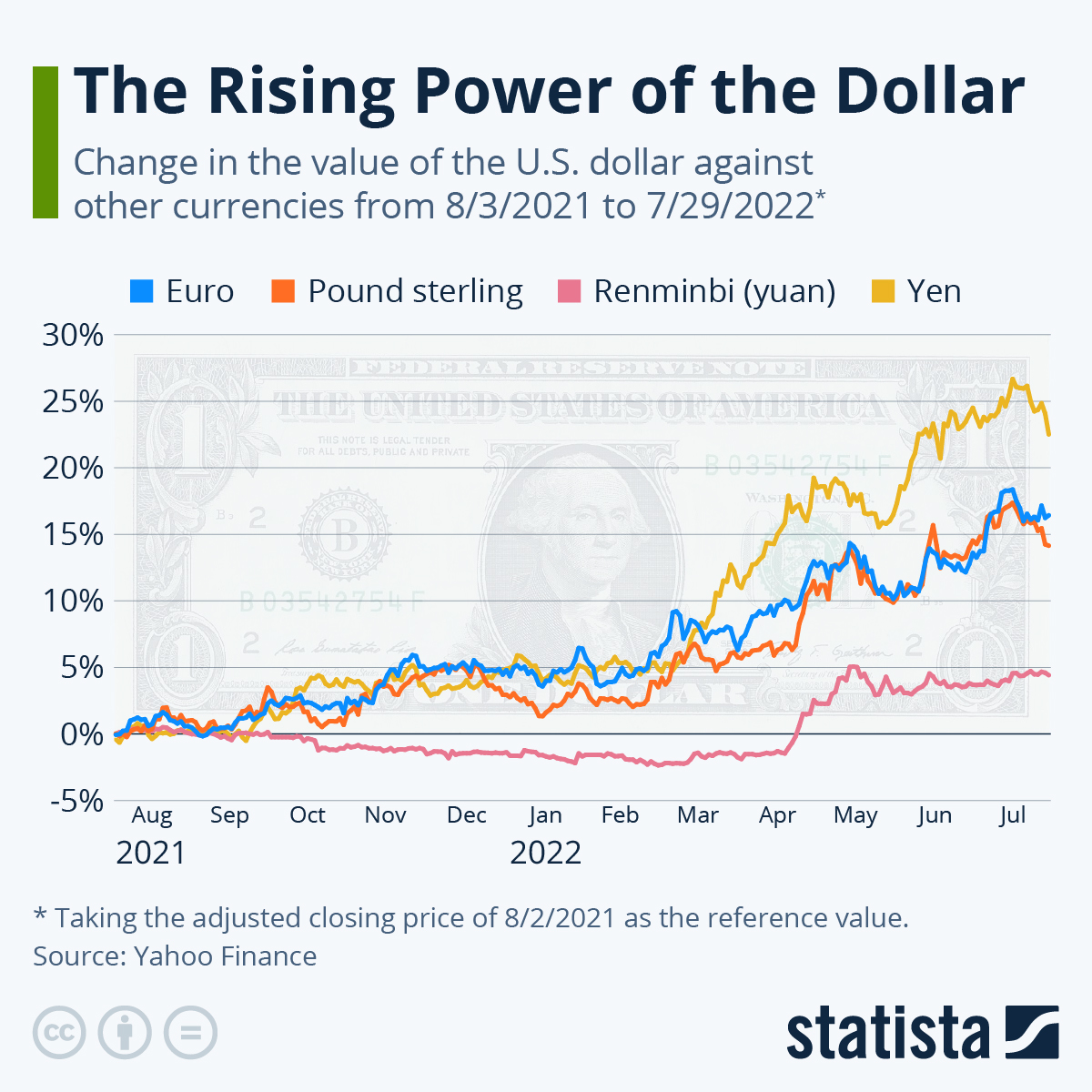

Usd Gains Momentum Trumps Change In Tone Impacts Dollars Performance Against Major Currencies

Apr 24, 2025

Usd Gains Momentum Trumps Change In Tone Impacts Dollars Performance Against Major Currencies

Apr 24, 2025 -

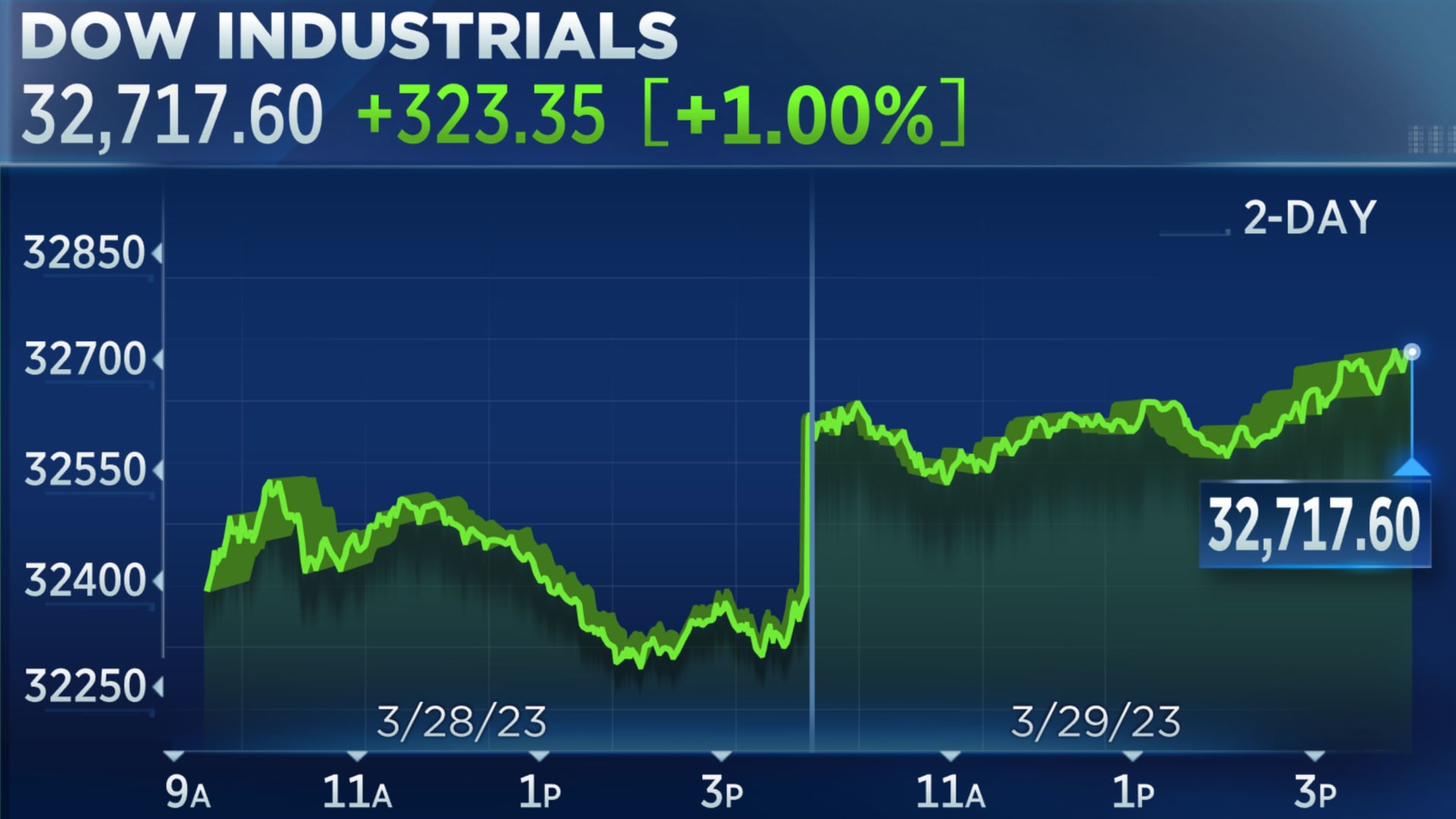

Dow Jones Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Jones Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025