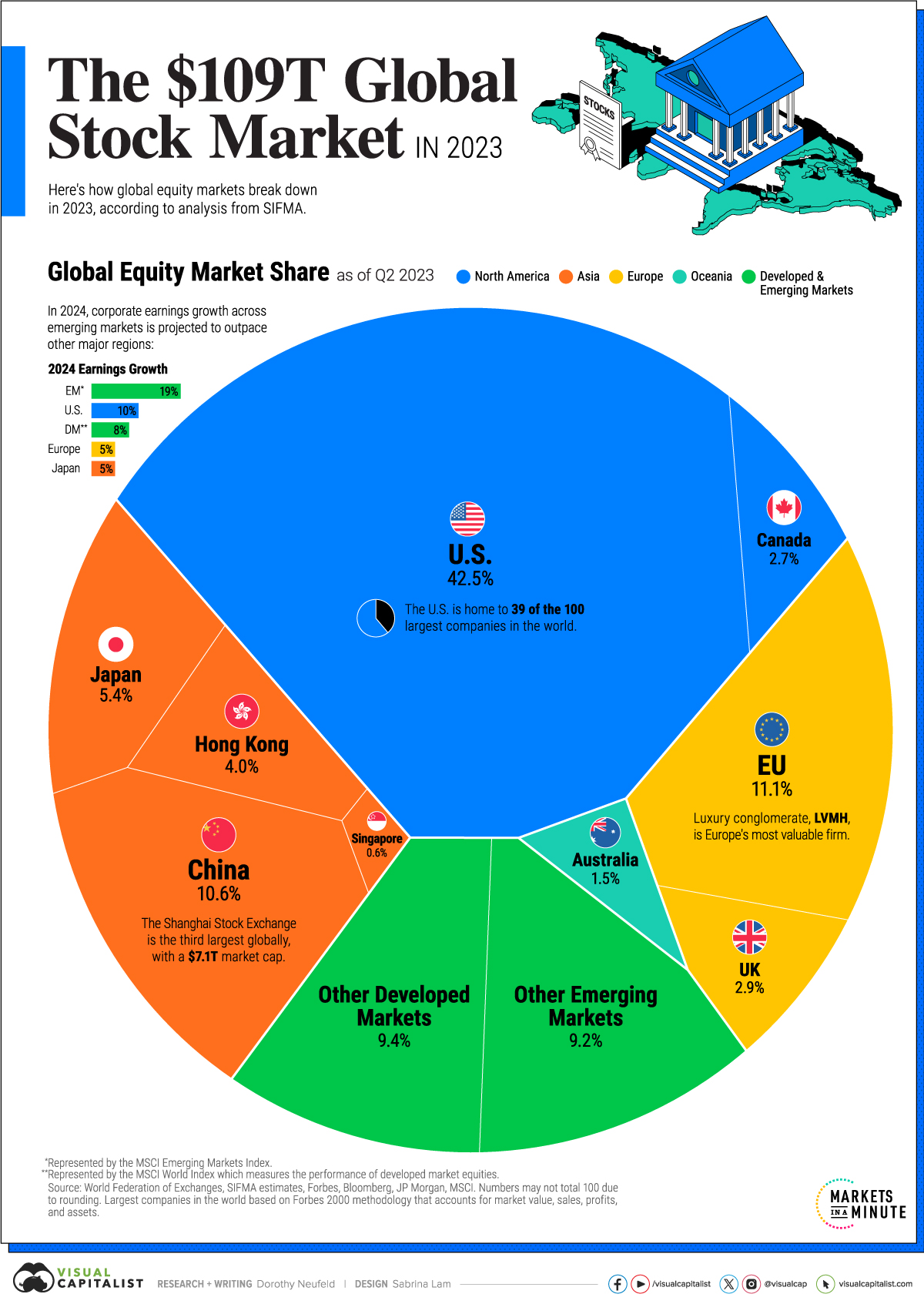

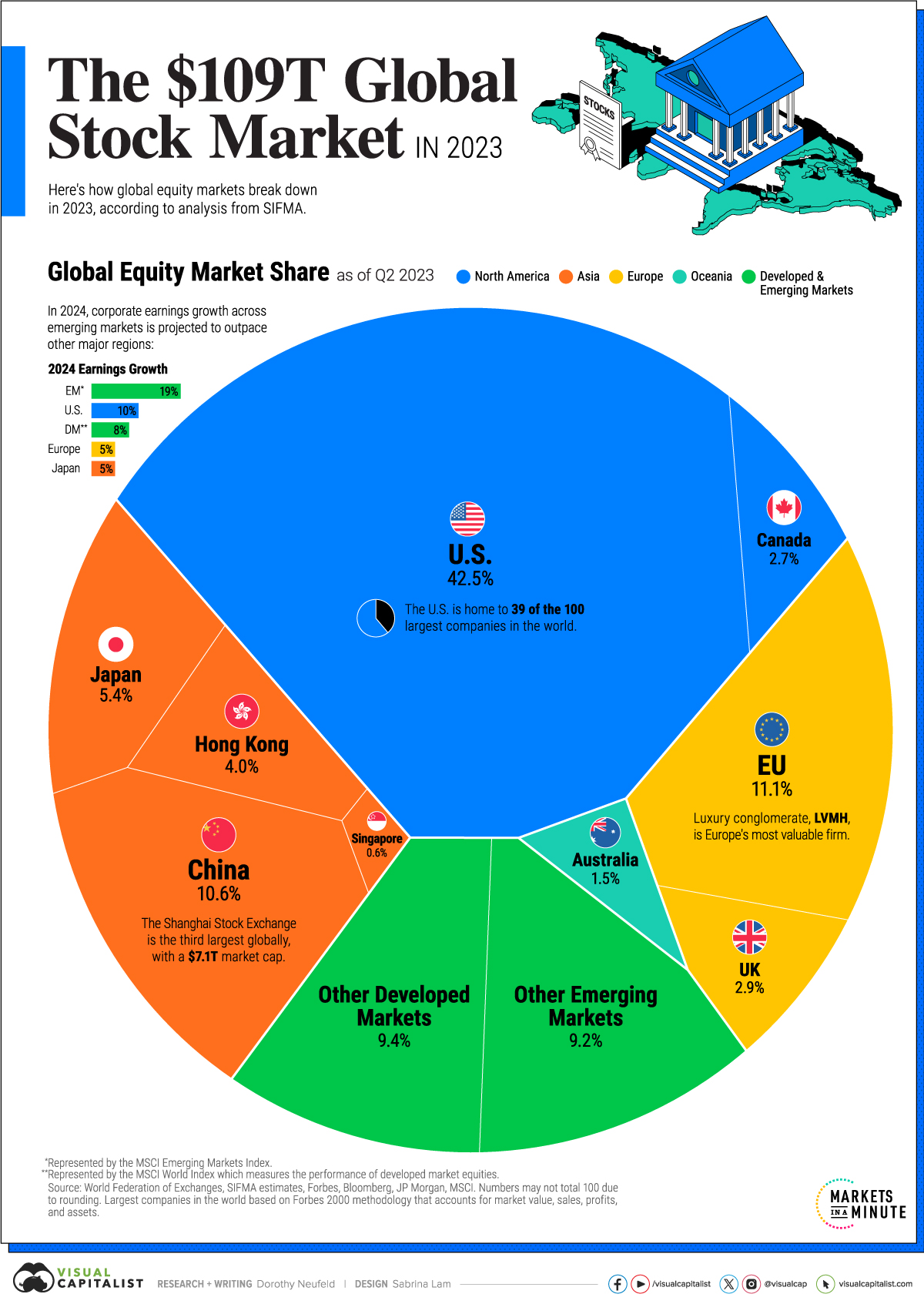

Strong Year For Emerging Markets: A Contrast To US Stock Market Decline

Table of Contents

Factors Driving Emerging Market Growth

Several key factors have contributed to the robust performance of emerging markets in 2023, creating compelling investment opportunities.

Resilient Economies in Emerging Markets

Several emerging economies have demonstrated remarkable resilience in the face of global economic headwinds.

- India's robust growth: India's GDP growth has remained strong, driven by a burgeoning domestic market and significant investment in infrastructure. Its young and growing population fuels consumer spending, contributing to its economic dynamism.

- Brazil's commodity boom: Brazil, a major exporter of commodities, has benefited from increased global demand and higher commodity prices, boosting its economic performance.

- Diversification away from US dependence: Many emerging economies have actively pursued economic diversification, reducing their reliance on the US market and making them less vulnerable to US economic downturns. This strategic move has insulated them from some of the negative impacts felt in the US.

These economies showcase strong economic growth, fueled by robust domestic demand and relatively controlled inflation. Their economic resilience makes them attractive for investors seeking stability and growth.

Beneficial Currency Fluctuations

Currency movements have played a significant role in the success of emerging markets. The weakening US dollar has made investments in emerging markets more appealing to international investors.

- Increased purchasing power: A weaker dollar translates to increased purchasing power for investors holding other currencies, making assets in emerging markets more affordable.

- Attractive investment yields: The relative strength of emerging market currencies against the dollar enhances the returns for international investors.

Understanding currency exchange rates and currency fluctuations is crucial for navigating the complexities of foreign exchange markets and making informed investment decisions.

Strategic Investment Opportunities

Emerging markets present exciting investment strategies across several high-growth sectors.

- Technology sector boom: Many emerging markets are experiencing rapid technological advancements, creating exciting opportunities in fintech, e-commerce, and other tech-related sectors.

- Infrastructure development: Significant investments in infrastructure projects, such as transportation and energy, offer substantial return on investment potential.

These high-growth sectors offer the possibility of significantly higher returns on investment than those found in more developed markets, thereby contributing to improved portfolio diversification.

Reasons for US Stock Market Decline

In contrast to the thriving emerging markets, the US stock market has faced several challenges.

Impact of Interest Rate Hikes

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have had a significant impact on the US stock market.

- Increased borrowing costs: Higher interest rates increase borrowing costs for businesses, impacting investment and potentially slowing economic growth.

- Reduced investor sentiment: Concerns about a potential recession and higher interest rates have dampened investor sentiment, leading to decreased stock valuations. This also affects market volatility.

Understanding the Federal Reserve's monetary policy and its impact on inflation is critical for investors navigating the US market.

Geopolitical Uncertainty

Global geopolitical events have contributed to market volatility in the US.

- War in Ukraine: The ongoing conflict in Ukraine has created significant uncertainty, impacting energy prices and global supply chains.

- Energy crisis: The energy crisis, exacerbated by geopolitical tensions, has fueled inflation and increased economic uncertainty.

These factors have increased geopolitical risk and global uncertainty, impacting investor confidence and leading to market fluctuations.

Tech Sector Correction

A potential correction in the US tech sector has also contributed to the overall market decline.

- Overvalued stocks: Concerns about overvalued stocks in the tech sector have prompted a reassessment of valuations.

- Slowing growth: Slower-than-expected growth in some tech companies has added to the negative sentiment.

This market correction within the tech sector, and the resulting impact on stock valuation, has had a significant ripple effect throughout the broader market.

Conclusion: Navigating Emerging Market Investment Opportunities

The contrasting performances of emerging markets and the US stock market highlight the importance of diversification. While the US market faces headwinds from interest rate hikes, geopolitical uncertainty, and a potential tech sector correction, emerging markets demonstrate resilience and significant growth potential. The factors driving this divergence, including robust economic growth in specific emerging economies, favorable currency fluctuations, and strong growth in key sectors, present compelling emerging market investment opportunities.

However, investing in emerging markets requires careful consideration of risk management. A diversified investment strategy and thorough risk assessment are crucial. Don't hesitate to seek advice from qualified financial advisors to develop a personalized investment plan that aligns with your risk tolerance and financial goals. Explore the potential of emerging market investment further – it might be the key to bolstering your portfolio's performance in these dynamic times.

Featured Posts

-

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 24, 2025

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 24, 2025 -

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

Apr 24, 2025

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

Apr 24, 2025 -

President Trumps Stance On Federal Reserve Chair Powell Remains Unchanged

Apr 24, 2025

President Trumps Stance On Federal Reserve Chair Powell Remains Unchanged

Apr 24, 2025 -

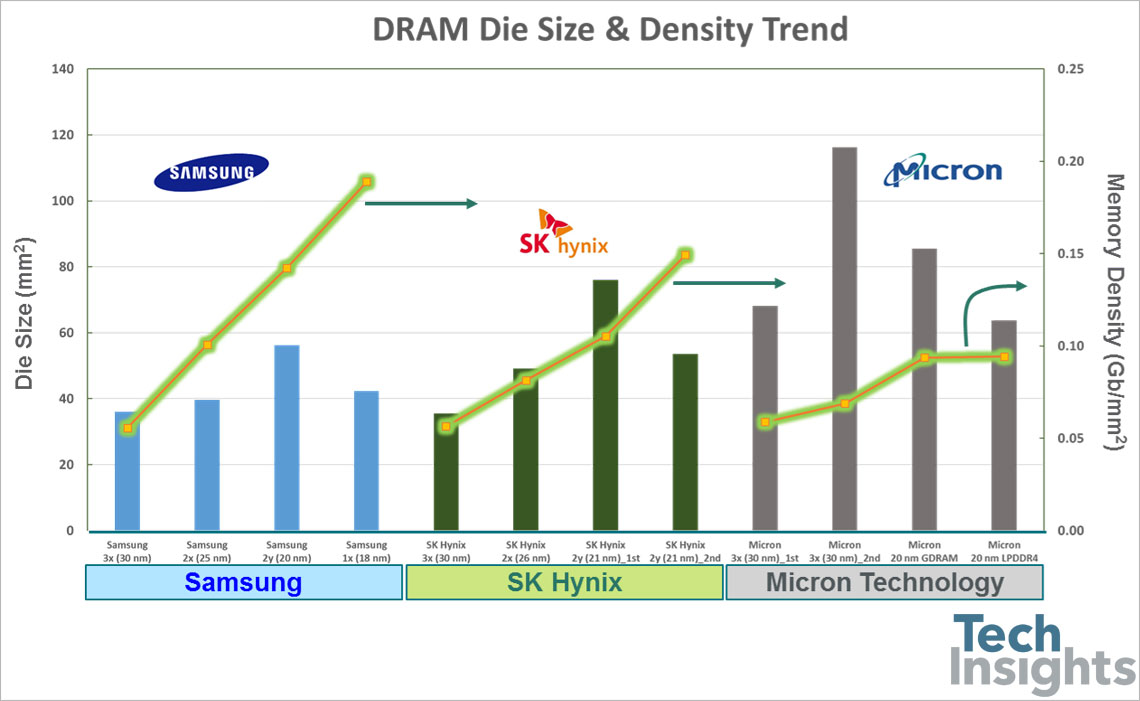

Sk Hynix Overtakes Samsung In Dram Market Ais Impact

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market Ais Impact

Apr 24, 2025 -

Trump Administration Shows Willingness To Negotiate With Harvard Following Lawsuit

Apr 24, 2025

Trump Administration Shows Willingness To Negotiate With Harvard Following Lawsuit

Apr 24, 2025