Recent Bitcoin (BTC) Rally: Factors Influencing Price Increase

Table of Contents

Increased Institutional Adoption

The growing involvement of institutional investors is a significant driver of the recent Bitcoin (BTC) rally. This increased participation signifies a shift towards wider acceptance and legitimacy within the traditional financial landscape.

Growing Interest from Large Investors:

- Examples of Institutional Investments: Several prominent examples include MicroStrategy's substantial Bitcoin holdings, Tesla's previous investment (and subsequent partial sale), and the growing adoption by various hedge funds and asset management firms. These large-scale investments inject significant capital into the market, increasing demand and price.

- Regulatory Changes Influencing Institutional Adoption: While regulatory clarity remains a work in progress globally, some jurisdictions are developing clearer frameworks for Bitcoin and digital assets, encouraging institutional participation. This reduced regulatory uncertainty reduces risk for large institutions.

- Impact of Grayscale Bitcoin Trust (GBTC): The Grayscale Bitcoin Trust, a publicly traded trust investing primarily in Bitcoin, has played a role, although its premium to NAV has fluctuated. Its existence provides another avenue for institutional access to Bitcoin.

Development of Bitcoin-related Financial Products:

- Examples of New Bitcoin Financial Products: The emergence of Bitcoin exchange-traded funds (ETFs) in some markets, alongside futures contracts and other derivatives, significantly enhances liquidity and facilitates institutional participation. These products offer exposure to Bitcoin with reduced complexities for traditional investors.

- Impact on Liquidity and Price Discovery: Improved liquidity, driven by these financial instruments, allows for more efficient price discovery, reducing volatility and attracting a wider range of investors. Greater liquidity translates to smoother trading and a more stable price action.

- Risks Associated with These Products: It's crucial to acknowledge the risks involved. Derivatives can amplify both gains and losses, and investors need to thoroughly understand the inherent volatility of the Bitcoin market.

Macroeconomic Factors and Inflation

Global macroeconomic factors, particularly inflationary pressures, have contributed significantly to the recent Bitcoin rally. Many view Bitcoin as a potential hedge against inflation and a store of value.

Inflationary Pressures and Safe-Haven Demand:

- Statistics on Inflation Rates: Rising inflation rates in many countries are prompting investors to seek alternative assets to protect their purchasing power. This search for inflation hedges boosts demand for assets perceived as less susceptible to currency devaluation.

- Comparison of Bitcoin's Performance Against Traditional Assets: While Bitcoin's price is notoriously volatile, its performance during periods of high inflation has sometimes outpaced traditional assets like gold and bonds, reinforcing its appeal as an inflation hedge.

- Arguments for Bitcoin as a Store of Value: Bitcoin's fixed supply of 21 million coins acts as a natural constraint, potentially making it a more reliable store of value compared to fiat currencies susceptible to inflationary pressures.

Impact of Monetary Policy:

- Examples of Central Bank Policies: Central banks' quantitative easing (QE) programs and other monetary policies designed to stimulate economies can lead to currency devaluation. This can increase the attractiveness of Bitcoin as an alternative asset.

- Effect on the Value of Fiat Currencies: The potential for debasement of fiat currencies due to expansionary monetary policies pushes investors towards assets perceived as more stable and less prone to manipulation.

- Subsequent Impact on Bitcoin Demand: This flight to safety and the desire to diversify away from traditional assets drives increased demand for Bitcoin, ultimately contributing to price appreciation.

Technological Developments and Network Upgrades

Technological improvements within the Bitcoin ecosystem further enhance its appeal and contribute to price increases.

Bitcoin's Growing Network Effects:

- Statistics on Transaction Volume: The increasing volume of Bitcoin transactions signifies growing adoption and usage. Higher transaction volumes indicate a maturing and more robust network.

- The Lightning Network's Progress: The Lightning Network, a layer-2 scaling solution for Bitcoin, improves transaction speed and reduces fees, enhancing the usability of Bitcoin for everyday transactions.

- Improvements in Scalability and Transaction Speed: Ongoing development efforts aim to further improve Bitcoin's scalability and transaction speed, making it a more efficient and practical payment system.

Regulatory Developments and Legal Clarity (Positive Impact):

- Examples of Positive Regulatory Shifts: While regulatory landscapes vary globally, positive developments, such as clearer guidelines and a reduction in ambiguity surrounding Bitcoin's legal status in some jurisdictions, boost investor confidence. A more predictable regulatory environment attracts institutional investment.

- Impact on Market Sentiment and Institutional Investment: Positive regulatory developments significantly improve market sentiment, reducing risk perception and attracting more institutional investors. Clearer regulations contribute to a more mature and stable market.

Conclusion

The recent Bitcoin (BTC) rally is a result of a confluence of factors: increased institutional adoption fueled by the development of Bitcoin-related financial products and growing interest from large investors; macroeconomic conditions characterized by inflationary pressures and the impact of monetary policies driving safe-haven demand; and ongoing technological developments improving Bitcoin's scalability and network effects along with positive regulatory developments. While this rally highlights Bitcoin’s potential, it's crucial to maintain a balanced perspective, acknowledging the inherent volatility of the cryptocurrency market. Understanding the factors driving this recent Bitcoin (BTC) rally is crucial for informed investment decisions. Continue your research and stay updated on the latest news and developments in the Bitcoin market to make well-informed choices.

Featured Posts

-

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Potential Sale Of Chip Tester Utac By Chinese Firm

Apr 24, 2025

Potential Sale Of Chip Tester Utac By Chinese Firm

Apr 24, 2025 -

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025 -

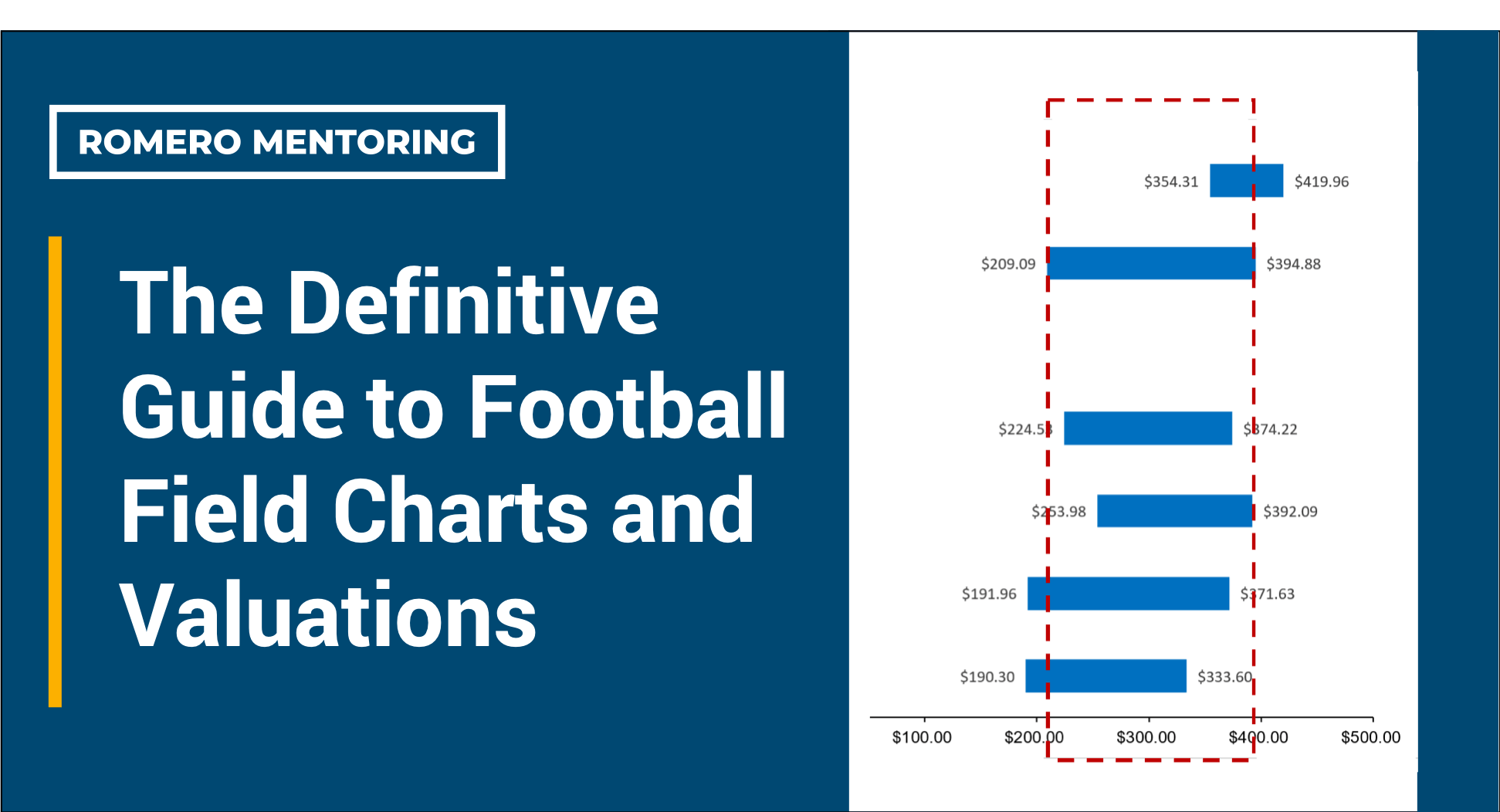

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

Apr 24, 2025

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

Apr 24, 2025 -

Teslas Q1 Earnings Political Controversy Impacts Financial Results

Apr 24, 2025

Teslas Q1 Earnings Political Controversy Impacts Financial Results

Apr 24, 2025